-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

1Q25 earnings turnaround: strong overseas growth and domestic market recovery

1Q25 earnings turnaround: strong overseas growth and domestic market recovery

-

下载次数:

2581 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-04-30

-

页数:

6页

联影医疗(688271)

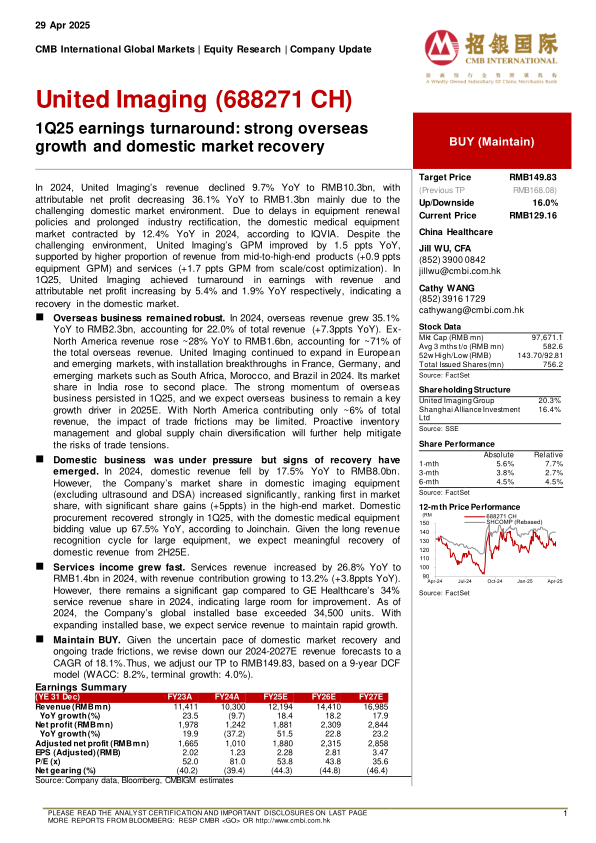

In 2024, United Imaging’s revenue declined 9.7% YoY to RMB10.3bn, withattributable net profit decreasing 36.1% YoY to RMB1.3bn mainly due to thechallenging domestic market environment. Due to delays in equipment renewalpolicies and prolonged industry rectification, the domestic medical equipmentmarket contracted by 12.4% YoY in 2024, according to IQVIA. Despite thechallenging environment, United Imaging’s GPM improved by 1.5 ppts YoY,supported by higher proportion of revenue from mid-to-high-end products (+0.9 pptsequipment GPM) and services (+1.7 ppts GPM from scale/cost optimization). In1Q25, United Imaging achieved turnaround in earnings with revenue andattributable net profit increasing by 5.4% and 1.9% YoY respectively, indicating arecovery in the domestic market.

Overseas business remained robust. In 2024, overseas revenue grew 35.1%YoY to RMB2.3bn, accounting for 22.0% of total revenue (+7.3ppts YoY). ExNorth America revenue rose ~28% YoY to RMB1.6bn, accounting for ~71% ofthe total overseas revenue. United Imaging continued to expand in Europeanand emerging markets, with installation breakthroughs in France, Germany, andemerging markets such as South Africa, Morocco, and Brazil in 2024. Its marketshare in India rose to second place. The strong momentum of overseasbusiness persisted in 1Q25, and we expect overseas business to remain a keygrowth driver in 2025E. With North America contributing only ~6% of totalrevenue, the impact of trade frictions may be limited. Proactive inventorymanagement and global supply chain diversification will further help mitigatethe risks of trade tensions.

Domestic business was under pressure but signs of recovery haveemerged. In 2024, domestic revenue fell by 17.5% YoY to RMB8.0bn.However, the Company’s market share in domestic imaging equipment(excluding ultrasound and DSA) increased significantly, ranking first in marketshare, with significant share gains (+5ppts) in the high-end market. Domesticprocurement recovered strongly in 1Q25, with the domestic medical equipmentbidding value up 67.5% YoY, according to Joinchain. Given the long revenuerecognition cycle for large equipment, we expect meaningful recovery ofdomestic revenue from 2H25E.

Services income grew fast. Services revenue increased by 26.8% YoY toRMB1.4bn in 2024, with revenue contribution growing to 13.2% (+3.8ppts YoY).However, there remains a significant gap compared to GE Healthcare’s 34%service revenue share in 2024, indicating large room for improvement. As of2024, the Company’s global installed base exceeded 34,500 units. Withexpanding installed base, we expect service revenue to maintain rapid growth.

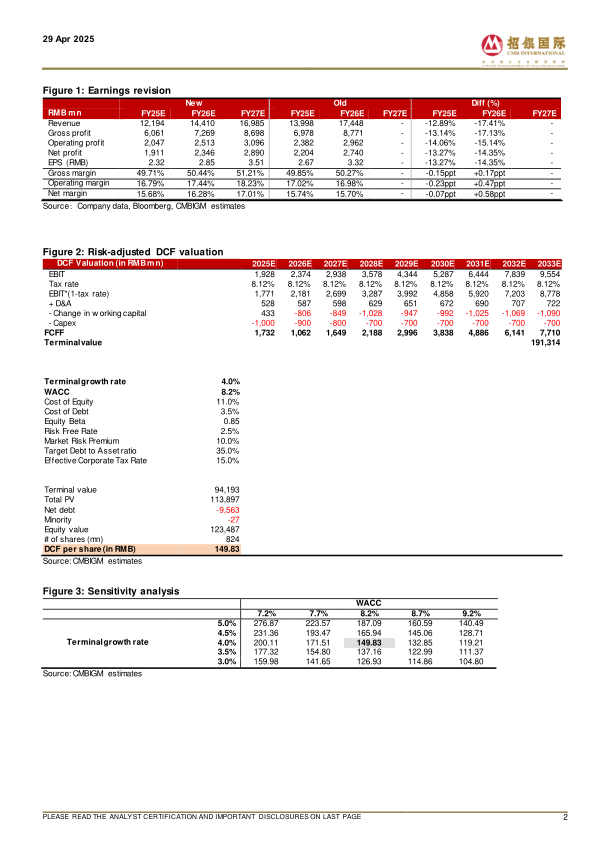

Maintain BUY. Given the uncertain pace of domestic market recovery andongoing trade frictions, we revise down our 2024-2027E revenue forecasts to aCAGR of 18.1%.Thus, we adjust our TP to RMB149.83, based on a 9-year DCFmodel (WACC: 8.2%, terminal growth: 4.0%)

中心思想

本报告对联影医疗(688271 CH)2025年一季度的业绩进行了分析,并对其未来发展前景进行了展望。

- 业绩反转与市场复苏: 联影医疗一季度业绩实现反转,得益于海外业务的强劲增长和国内市场的逐步复苏。

- 维持买入评级: 尽管国内市场复苏步伐存在不确定性以及贸易摩擦持续,但维持对联影医疗的买入评级,并基于DCF模型调整目标价至人民币149.83元。

主要内容

2024年业绩回顾:挑战与亮点并存

2024年,联影医疗的收入同比下降9.7%至人民币103亿元,归母净利润同比下降36.1%至人民币13亿元,主要受国内市场环境挑战的影响。

- 国内市场承压: 受设备更新政策延迟和行业整顿影响,国内医疗设备市场萎缩。

- 毛利率提升: 通过提高中高端产品收入占比和服务规模化及成本优化,毛利率同比提升1.5个百分点。

2025年一季度业绩:盈利能力显著回升

2025年一季度,联影医疗的收入和归母净利润分别同比增长5.4%和1.9%,表明国内市场正在复苏。

海外业务:持续强劲增长的引擎

- 海外收入增长迅速: 2024年,海外收入同比增长35.1%至人民币23亿元,占总收入的22.0%。北美收入同比增长约28%至人民币16亿元,占海外总收入的约71%。

- 市场份额扩张: 在法国、德国以及南非、摩洛哥和巴西等新兴市场取得安装突破,在印度的市场份额升至第二位。

国内业务:复苏迹象显现

- 国内市场份额提升: 2024年,国内收入同比下降17.5%至人民币80亿元,但在国内影像设备(不包括超声和DSA)市场份额显著提升,高端市场份额增加5个百分点,位居市场第一。

- 采购复苏: 2025年一季度,国内医疗设备招标金额同比增长67.5%。

服务收入:快速增长的新动力

- 服务收入占比提升: 2024年,服务收入同比增长26.8%至人民币14亿元,收入贡献增长至13.2%。

- 增长空间广阔: 截至2024年,全球装机量超过34,500台,服务收入仍有较大提升空间。

盈利预测调整与估值

- 下调收入预测: 考虑到国内市场复苏的不确定性和持续的贸易摩擦,将2024-2027年的收入预测下调至复合年增长率18.1%。

- 目标价调整: 基于9年期DCF模型(WACC:8.2%,终值增长率:4.0%),将目标价调整至人民币149.83元。

总结

本报告分析了联影医疗2024年的业绩表现和2025年一季度的业绩反转,强调了海外业务的强劲增长和服务收入的快速提升。尽管国内市场复苏存在不确定性,但联影医疗的市场份额持续提升,未来发展潜力巨大。维持买入评级,并根据市场变化调整了盈利预测和目标价。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送