-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

To navigate macro uncertainties with a good start in 1Q25

To navigate macro uncertainties with a good start in 1Q25

-

下载次数:

2449 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-04-30

-

页数:

6页

药明康德(603259)

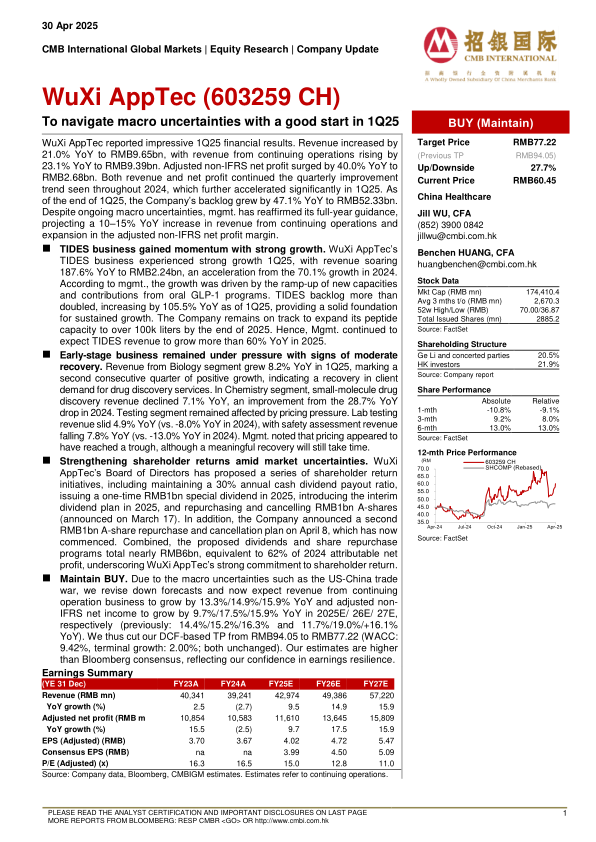

WuXi AppTec reported impressive 1Q25 financial results. Revenue increased by21.0% YoY to RMB9.65bn, with revenue from continuing operations rising by23.1% YoY to RMB9.39bn. Adjusted non-IFRS net profit surged by 40.0% YoY toRMB2.68bn. Both revenue and net profit continued the quarterly improvementtrend seen throughout 2024, which further accelerated significantly in 1Q25. Asof the end of 1Q25, the Company’s backlog grew by 47.1% YoY to RMB52.33bn.Despite ongoing macro uncertainties, mgmt. has reaffirmed its full-year guidance,projecting a 10–15% YoY increase in revenue from continuing operations andexpansion in the adjusted non-IFRS net profit margin.

TIDES business gained momentum with strong growth. WuXi AppTec’sTIDES business experienced strong growth 1Q25, with revenue soaring187.6% YoY to RMB2.24bn, an acceleration from the 70.1% growth in 2024.According to mgmt., the growth was driven by the ramp-up of new capacitiesand contributions from oral GLP-1 programs. TIDES backlog more thandoubled, increasing by 105.5% YoY as of 1Q25, providing a solid foundationfor sustained growth. The Company remains on track to expand its peptidecapacity to over 100k liters by the end of 2025. Hence, Mgmt. continued toexpect TIDES revenue to grow more than 60% YoY in 2025.

Early-stage business remained under pressure with signs of moderaterecovery. Revenue from Biology segment grew 8.2% YoY in 1Q25, marking asecond consecutive quarter of positive growth, indicating a recovery in clientdemand for drug discovery services. In Chemistry segment, small-molecule drugdiscovery revenue declined 7.1% YoY, an improvement from the 28.7% YoYdrop in 2024. Testing segment remained affected by pricing pressure. Lab testingrevenue slid 4.9% YoY (vs. -8.0% YoY in 2024), with safety assessment revenuefalling 7.8% YoY (vs. -13.0% YoY in 2024). Mgmt. noted that pricing appeared tohave reached a trough, although a meaningful recovery will still take time.

Strengthening shareholder returns amid market uncertainties. WuXiAppTec’s Board of Directors has proposed a series of shareholder returninitiatives, including maintaining a 30% annual cash dividend payout ratio,issuing a one-time RMB1bn special dividend in 2025, introducing the interimdividend plan in 2025, and repurchasing and cancelling RMB1bn A-shares(announced on March 17). In addition, the Company announced a secondRMB1bn A-share repurchase and cancellation plan on April 8, which has nowcommenced. Combined, the proposed dividends and share repurchaseprograms total nearly RMB6bn, equivalent to 62% of 2024 attributable netprofit, underscoring WuXi AppTec’s strong commitment to shareholder return.

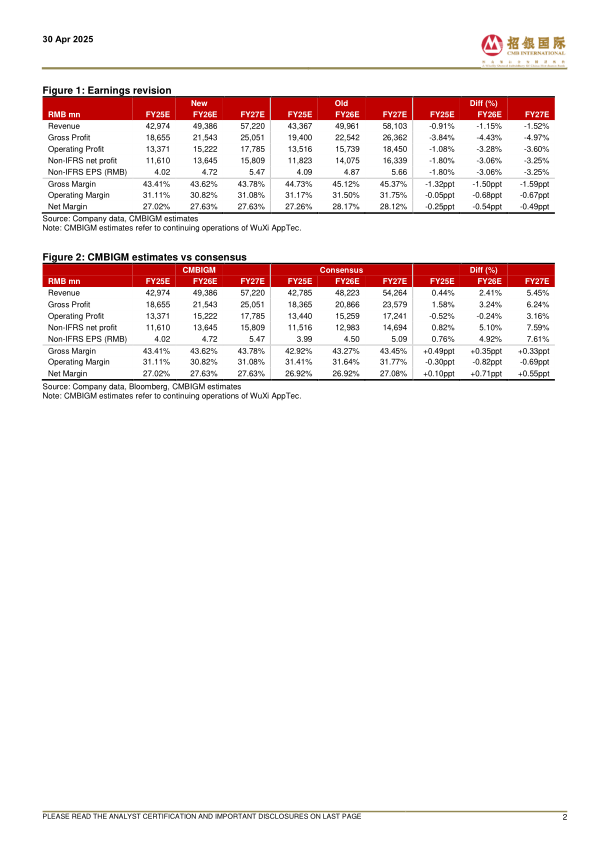

Maintain BUY. Due to the macro uncertainties such as the US-China tradewar, we revise down forecasts and now expect revenue from continuingoperation business to grow by 13.3%/14.9%/15.9% YoY and adjusted nonIFRS net income to grow by 9.7%/17.5%/15.9% YoY in 2025E/ 26E/ 27E,respectively (previously: 14.4%/15.2%/16.3% and 11.7%/19.0%/+16.1%YoY). We thus cut our DCF-based TP from RMB94.05 to RMB77.22 (WACC:9.42%, terminal growth: 2.00%; both unchanged). Our estimates are higherthan Bloomberg consensus, reflecting our confidence in earnings resilience

中心思想

- 业绩表现与增长动力: 药明康德(603259 CH) 2025年第一季度业绩表现强劲,收入同比增长21.0%至人民币96.5亿元,经调整Non-IFRS净利润同比增长40.0%至人民币26.8亿元。TIDES业务增长势头迅猛,同比增长187.6%至人民币22.4亿元,成为主要增长动力。

- 战略调整与股东回报: 面对宏观不确定性,公司重申全年指引,预计持续经营业务收入同比增长10-15%,并扩大调整后的Non-IFRS净利润率。同时,公司积极加强股东回报,包括维持30%的年度现金分红比例、派发一次性人民币10亿元特别股息、推出中期股息计划以及回购并注销A股。

- 评级调整与盈利预测: 考虑到宏观不确定性,报告下调了对药明康德的盈利预测,但维持“买入”评级。新的目标价为人民币77.22元,基于DCF估值法,WACC为9.42%,长期增长率为2.00%。

主要内容

1Q25业绩回顾:业绩超预期增长,全年指引不变

药明康德公布了令人印象深刻的2025年第一季度财务业绩。收入同比增长21.0%至人民币96.5亿元,其中持续经营业务收入同比增长23.1%至人民币93.9亿元。调整后的非IFRS净利润大幅增长40.0%至人民币26.8亿元。收入和净利润均延续了2024年以来的季度改善趋势,并在2025年第一季度显著加速。截至2025年第一季度末,公司积压订单同比增长47.1%至人民币523.3亿元。尽管宏观环境持续存在不确定性,但管理层重申了全年业绩指引,预计持续经营业务收入同比增长10-15%,并扩大调整后的非IFRS净利润率。

TIDES业务:高速增长,成为主要增长引擎

药明康德的TIDES业务在2025年第一季度经历了强劲增长,收入同比增长187.6%至人民币22.4亿元,较2024年的70.1%的增速大幅提升。管理层表示,这一增长主要得益于新产能的提升以及口服GLP-1项目的贡献。TIDES业务的积压订单翻了一番以上,截至2025年第一季度同比增长105.5%,为持续增长奠定了坚实的基础。公司仍有望在2025年底前将其肽产能扩大至超过10万升。因此,管理层预计TIDES业务收入在2025年将同比增长60%以上。

早期业务:面临压力,复苏迹象显现

生物业务收入同比增长8.2%,标志着连续第二个季度实现正增长,表明客户对药物发现服务的需求正在复苏。在化学业务方面,小分子药物发现收入同比下降7.1%,较2024年28.7%的降幅有所改善。测试业务仍然受到定价压力的影响。实验室测试收入同比下滑4.9%(2024年为-8.0%),安全评估收入同比下降7.8%(2024年为-13.0%)。管理层指出,定价似乎已经触底,但有意义的复苏仍需时日。

股东回报:多项举措并举,提升股东价值

药明康德董事会提出了一系列股东回报计划,包括维持30%的年度现金分红比例,在2025年派发一次性人民币10亿元特别股息,在2025年推出中期股息计划,以及回购并注销人民币10亿元A股(3月17日宣布)。此外,公司于4月8日宣布了第二个人民币10亿元A股回购和注销计划,目前已开始实施。拟议的股息和股票回购计划总额接近人民币60亿元,相当于2024年归属于母公司净利润的62%,彰显了药明康德对股东回报的坚定承诺。

盈利预测与估值:下调盈利预测,维持“买入”评级

由于中美贸易战等宏观不确定性因素,报告下调了盈利预测,预计2025E/26E/27E持续经营业务收入将分别同比增长13.3%/14.9%/15.9%(此前为14.4%/15.2%/16.3%),调整后的非IFRS净利润将分别同比增长9.7%/17.5%/15.9%(此前为11.7%/19.0%/+16.1%)。因此,将基于DCF的TP从人民币94.05元下调至人民币77.22元(WACC:9.42%,长期增长率:2.00%;均未改变)。该估值高于彭博一致预期,反映了对盈利韧性的信心。

总结

- 核心业务稳健增长: 药明康德一季度业绩表现出色,TIDES业务成为增长亮点,早期业务也呈现复苏迹象。

- 股东回报计划积极: 公司推出多项股东回报计划,彰显了对股东价值的重视。

- 维持“买入”评级: 尽管下调了盈利预测,但考虑到公司的盈利能力和增长潜力,维持“买入”评级。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送