-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Anticipating a rapid rebound in domestic business

Anticipating a rapid rebound in domestic business

-

下载次数:

2535 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-11-04

-

页数:

6页

联影医疗(688271)

United Imaging’s 9M24 revenue declined by 6.4% YoY to RMB6,954mn, with 3Q24revenue down by 25.0% YoY to RMB1.6bn. This downturn was primarily due to achallenging domestic market environment, marked by stringent industry regulationsand delays in equipment renewal projects. Attributable net profit in 9M24 decreasedby 36.9% YoY to RMB671mn, with net profit margin falling by 4.7 ppts. Despitethese near-term challenges, United Imaging maintained its R&D expenditures andactively pursued expansion in international markets, which impacted profitability inthe third quarter. Looking forward, as the implementation of equipment renewalprojects has gradually picked up pace, United Imaging's revenue and net profitmargins are expected to significantly improve in 2025E, in our view.

Robust overseas growth momentum. In 9M24, United Imaging’s overseasrevenue grew 36.5% YoY to RMB1,404mn, accounting for 20.2% (+6.35 ppts)of total revenue. This accelerated growth continued into the third quarter, withrevenues increasing by 51.7% YoY to RMB471mn. Strong performances werenoted across North America, the Asia-Pacific region, and emerging markets. AsUnited Imaging continues to enhance its overseas localization and servicecapabilities, we believe it is poised to strengthen its global competitiveness,better navigate geopolitical challenges, and sustain rapid growth internationally.

Strong growth in recurring revenue. In 9M24, revenue from maintenanceservices increased by 27.3% YoY to RMB967mn, accounting for 13.9% (+3.7ppts) of the total revenue. With a global installed base now exceeding 31,000units, United Imaging's service revenue contribution remains lower comparedto global industry leaders like GE Healthcare (32.9% in 2023) and Philips(27.7% in 2023). However, with the expanding installed base and an enhancedglobal service network, we expect United Imaging’s recurring revenue tocontinue its rapid increase, offering resilience against industry fluctuations.

Medical equipment renewal projects set to materialize. Mgmt. has notedthat medical equipment renewal projects began implementation in earlyOctober, with multiple procurement activities underway. Additionally, somepreviously delayed equipment procurements, halted due to policy uncertainties,have now restarted. These developments lay the foundation for a recovery inUnited Imaging’s domestic business in 4Q24 and 2025. However, due tostringent industry regulations, the procurement process has become moreprotracted. The installation and revenue recognition timelines for largeequipment are also relatively long. Consequently, the positive impact of thisprocurement rebound is expected to be primarily reflected in 2025, in our view.

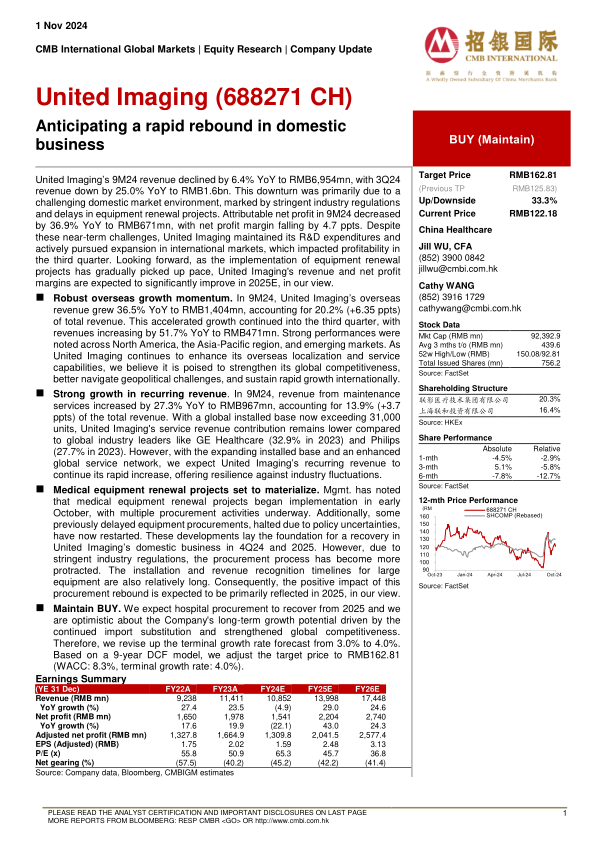

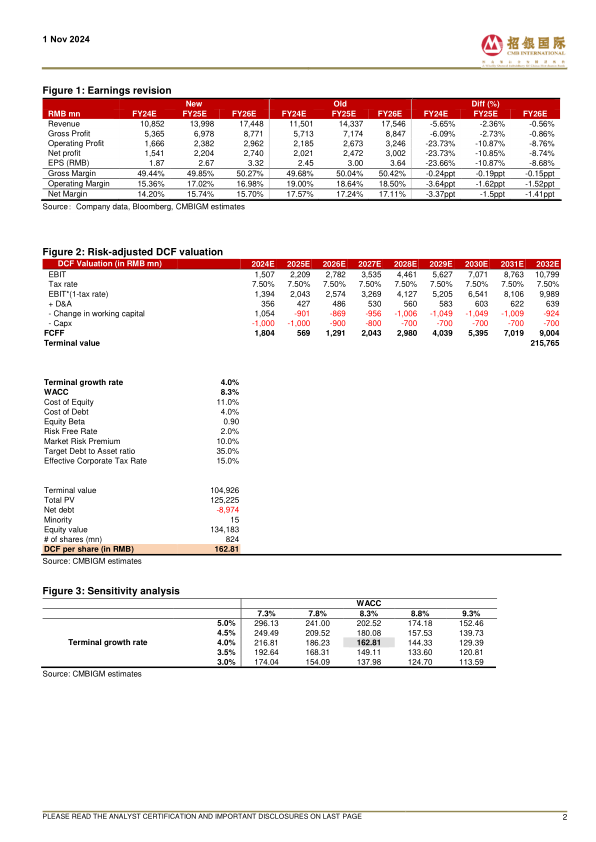

Maintain BUY. We expect hospital procurement to recover from 2025 and weare optimistic about the Company's long-term growth potential driven by thecontinued import substitution and strengthened global competitiveness.Therefore, we revise up the terminal growth rate forecast from 3.0% to 4.0%.Based on a 9-year DCF model, we adjust the target price to RMB162.81(WACC: 8.3%, terminal growth rate: 4.0%).

中心思想

本报告主要分析了联影医疗(688271 CH)在2024年前三季度的业绩表现,并展望了未来的发展前景。核心观点如下:

- 国内业务有望快速反弹: 尽管短期内面临国内市场挑战,但随着医疗设备更新项目的逐步实施,预计联影医疗的收入和净利润率将在2025年显著提高。

- 海外市场增长强劲: 联影医疗在海外市场实现了强劲增长,尤其是在北美、亚太地区和新兴市场。随着海外本地化和服务能力的不断增强,有望进一步提升全球竞争力。

主要内容

公司业绩回顾:短期业绩下滑,研发投入不减

联影医疗2024年前三季度收入同比下降6.4%至人民币69.54亿元,其中第三季度收入同比下降25.0%至人民币16亿元。业绩下滑主要由于国内市场环境充满挑战,行业监管严格以及设备更新项目延迟。前三季度归属于母公司的净利润同比下降36.9%至人民币6.71亿元,净利润率下降4.7个百分点。尽管面临短期挑战,联影医疗维持了研发支出,并积极拓展国际市场,但这影响了第三季度的盈利能力。

海外业务分析:海外市场增长强劲,全球竞争力提升

2024年前三季度,联影医疗的海外收入同比增长36.5%至人民币14.04亿元,占总收入的20.2%(+6.35个百分点)。第三季度海外收入同比增长51.7%至人民币4.71亿元,北美、亚太和新兴市场表现强劲。随着联影医疗不断加强海外本地化和服务能力,有望增强其全球竞争力,更好地应对地缘政治挑战,并保持国际市场的快速增长。

经常性收入增长:装机量提升,服务收入潜力巨大

2024年前三季度,维护服务收入同比增长27.3%至人民币9.67亿元,占总收入的13.9%(+3.7个百分点)。受益于全球超过31,000台的装机量,联影医疗的服务收入贡献仍然低于GE医疗(2023年为32.9%)和飞利浦(2023年为27.7%)等全球行业领导者。随着装机量的扩大和全球服务网络的增强,预计联影医疗的经常性收入将继续快速增长,从而增强应对行业波动的能力。

国内市场展望:设备更新项目落地,业绩有望复苏

管理层指出,医疗设备更新项目已于10月初开始实施,多项采购活动正在进行中。此外,由于政策不确定性而暂停的部分设备采购已重新启动。这些进展为联影医疗国内业务在2024年第四季度和2025年的复苏奠定了基础。但由于行业监管严格,采购流程变得更加漫长,大型设备的安装和收入确认时间也相对较长。因此,预计此次采购反弹的积极影响将主要体现在2025年。

盈利预测与估值:维持买入评级,上调目标价

预计医院采购将从2025年开始复苏,并对公司在进口替代和全球竞争力增强的推动下的长期增长潜力持乐观态度。因此,将终端增长率预测从3.0%上调至4.0%。基于9年期DCF模型,将目标价调整至人民币162.81元(WACC:8.3%,终端增长率:4.0%)。维持买入评级。

总结

本报告对联影医疗的最新业绩进行了分析,并对公司未来的发展前景进行了展望。尽管短期内面临国内市场挑战,但联影医疗在海外市场表现强劲,经常性收入持续增长,且国内医疗设备更新项目有望推动业绩复苏。因此,维持对联影医疗的买入评级,并上调目标价至人民币162.81元。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送