-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Strengthened earnings certainty drives valuation recovery

Strengthened earnings certainty drives valuation recovery

-

下载次数:

1997 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-03-19

-

页数:

6页

药明康德(603259)

WuXi AppTec reported a YoY revenue decline of 2.73%, to RMB39.2bn, and a2.5% decrease in adjusted non-IFRS net profit, to RMB10.6bn. However,earnings showed encouraging improvement throughout 2024, resulting in apositive revenue and profit growth in 4Q24. The TIDES business remained theprimary growth engine, with full-year revenue up by 70.1% YoY. The Company'sbacklog as of year-end 2024 expanded significantly, growing 47% YoY toRMB49.3bn. Notably, TIDES backlog experienced a substantial 103.9% YoYincrease in 2024. Fuelled by robust order book, management offered a positiveoutlook for 2025, forecasting 10-15% YoY revenue growth in continuingoperations and further enhancement of the adjusted non-IFRS net profit margin.

Strong order growth bolsters future revenue visibility. WuXi AppTec'sbacklog at end-2024 grew by a significant 47% YoY, reaching RMB49.3bn.This represents an acceleration from the 35.2% growth seen at the end of3Q24. Positive trends were evident across segments. CDMO businesssecured 25 new Ph3 and commercial projects in 2024 (vs 20 added in 2023).Biology segment returned to positive revenue growth in 4Q24, posting YoYand QoQ increases of 9.3% and 9.2%, respectively, signaling an improvingtrend in early-stage R&D demand. Furthermore, revenue from Top20 globalpharma clients rose by 24.1% YoY (excl. COVID related projects), expeditingfrom the 23.1% growth in 9M24. These metrics underscore the increasingvisibility of the Company's future revenue. Given the positive outlook for futuredemand, the Company plans to boost capex by 75%-100% YoY in 2025 toRMB7-8bn.

TIDES business sustains strong growth trajectory. TIDES revenue in2024 climbed 70.1% YoY, with backlog expanded by 103.9% YoY. Underlyingdemand for polypeptide manufacturing remains robust in the market. TheCompany's polypeptide capacity reached 41k liters by end-2024, with plansfor a further increase exceeding 100k liters by late 2025, demonstrating WuXiAppTec’s commitment to meeting the growing customer demand. Mgmtanticipates TIDES revenue growth of over 60% YoY in 2025.

Ongoing commitment to shareholder returns. Amidst macroeconomicuncertainties in 2024, WuXi AppTec strengthened its commitment toshareholder returns. The Company completed RMB4.0bn in sharerepurchases and cancellations in 2024 and maintained a dividend payoutratio of 30% for the year. To further enhance returns, mgmt announced a onetime special dividend of RMB1.0bn, alongside a 2025 interim dividend. Mgmtalso indicated plans to repurchase RMB1.0bn of A-shares in 2025.

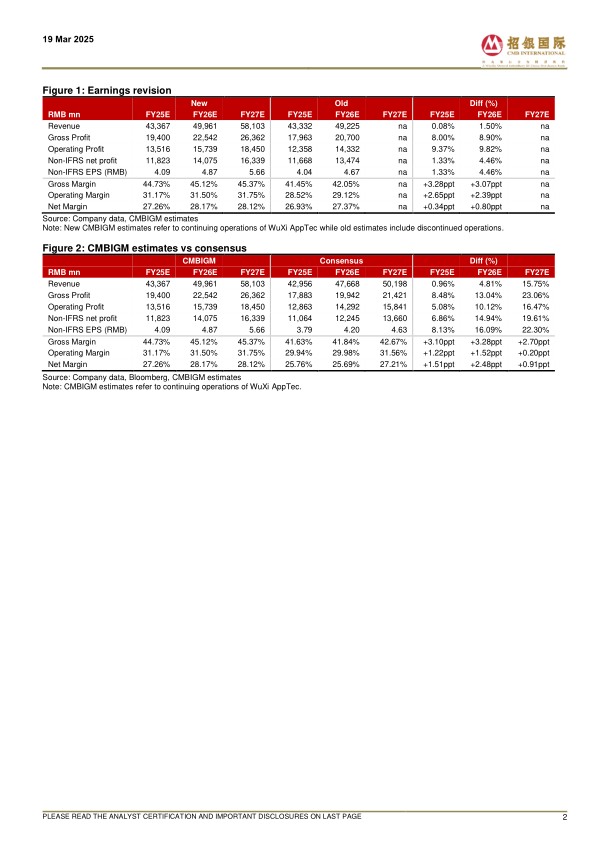

Maintain BUY. We raise our TP from RMB78.51 to RMB94.05 (based on a10-year DCF model with WACC of 9.42% and terminal growth of 2.0%), tofactor in the earnings recovery. We forecast the continuing operation revenueto grow by 14.4%/ 15.2%/ 16.3% YoY and adjusted non-IFRS net income togrow by 11.7%/ 19.0%/ +16.1% YoY in 2025E/ 26E/ 27E, respectively. Our2025E/ 26E/ 27E forecasts of adjusted non-IFRS profit are 6.9%/ 14.9%/19.6% higher than consensus.

中心思想

本报告对药明康德(603259 CH)的盈利确定性增强推动估值复苏进行了分析,核心观点如下:

- 订单增长强劲,提升未来收入可见性: 药明康德2024年末的积压订单同比增长显著,达到人民币493亿元,各业务部门均呈现积极趋势,表明公司未来收入具有较高的可见性。

- TIDES业务保持强劲增长势头: TIDES业务收入在2024年同比增长70.1%,积压订单同比增长103.9%,多肽产能持续扩张,管理层预计2025年TIDES业务收入将同比增长超过60%。

- 持续致力于股东回报: 面对宏观经济不确定性,药明康德加强了对股东回报的承诺,完成了人民币40亿元的股份回购和注销,并维持30%的年度股息支付率,同时宣布一次性特别股息和2025年中期股息计划,以及计划回购人民币10亿元A股。

主要内容

公司业绩回顾与展望

药明康德报告2024年收入同比下降2.73%,至人民币392亿元,调整后非IFRS净利润同比下降2.5%,至人民币106亿元。但全年盈利呈现改善趋势,第四季度收入和利润实现正增长。TIDES业务仍然是主要的增长引擎,全年收入同比增长70.1%。截至2024年末,公司在中国医疗保健领域的积压订单大幅增长,同比增长47%至人民币493亿元,其中TIDES积压订单同比增长103.9%。受益于强劲的订单,管理层对2025年持乐观态度,预计持续经营业务收入将同比增长10-15%,调整后非IFRS净利润率将进一步提高。

订单增长与未来收入可见性

药明康德2024年末的积压订单同比增长显著,达到人民币493亿元,高于三季度末的35.2%的增速。CDMO业务在2024年新增25个Ph4和商业项目(2023年新增20个)。生物业务在第四季度恢复正增长,同比增长9.3%,环比增长9.2%,表明早期研发需求正在改善。来自Top20全球制药客户的收入同比增长24.1%(不包括COVID相关项目),高于9M24的23.1%的增速。鉴于对未来需求的乐观展望,公司计划在2025年将资本支出增加75%-100%,达到人民币70-80亿元。

TIDES业务的增长

TIDES业务在2024年收入同比增长70.1%,积压订单同比增长103.9%。市场对多肽生产的需求依然强劲。截至2024年末,公司的多肽产能达到4.1万升,并计划在2025年末增加到超过10万升,以满足不断增长的客户需求。管理层预计TIDES业务在2025年将同比增长超过60%。

股东回报

在2024年宏观经济不确定性的背景下,药明康德加强了对股东回报的承诺。公司在2024年完成了人民币40亿元的股份回购和注销,并维持30%的年度股息支付率。为了进一步提高回报,管理层宣布了一次性特别股息人民币10亿元,以及2025年中期股息。管理层还表示计划在2025年回购人民币10亿元的A股。

盈利预测与估值

维持“买入”评级,并将目标价从人民币78.51元上调至人民币94.05元(基于10年期DCF模型,WACC为9.42%,永续增长率为2.0%),以反映盈利复苏。预计2025E/26E/27E持续经营业务收入将同比增长14.4%/15.2%/16.3%,调整后非IFRS净利润将同比增长11.7%/19.0%/+16.1%。2025E/26E/27E调整后非IFRS利润预测比市场一致预期高6.9%/14.9%/19.6%。

总结

本报告分析了药明康德的最新业绩和未来展望,强调了公司订单增长强劲、TIDES业务高速发展以及对股东回报的承诺。基于对公司盈利能力的乐观预期,维持“买入”评级,并上调目标价至人民币94.05元。报告还详细分析了公司的收入、利润、现金流和资产负债表,并提供了与市场一致预期的对比,以及DCF估值的敏感性分析。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送