-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Awaiting domestic demand rebound

Awaiting domestic demand rebound

-

下载次数:

2844 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-04-30

-

页数:

6页

迈瑞医疗(300760)

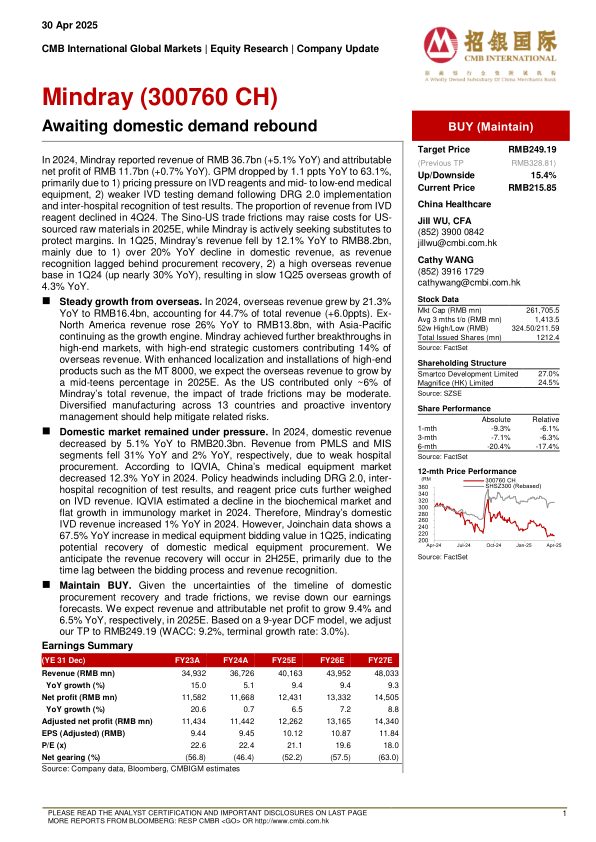

In2024,Mindray reported revenue of RMB36.7bn(+5.1%YoY)and attributablenet profit of RMB11.7bn(+0.7%YoY).GPM dropped by1.1ppts YoY to63.1%,primarily due to1)pricing pressure on IVD reagents and mid-to low-end medicalequipment,2)weaker IVD testing demand following DRG2.0implementationand inter-hospital recognition of test results.The proportion of revenue from IVDreagent declined in4Q24.The Sino-US trade frictions may raise costs for US-sourced raw materials in2025E,while Mindray is actively seeking substitutes toprotect margins.In1Q25,Mindray’s revenue fell by12.1%YoY to RMB8.2bn,mainly due to1)over20%YoY decline in domestic revenue,as revenuerecognition lagged behind procurement recovery,2)a high overseas revenuebase in1Q24(up nearly30%YoY),resulting in slow1Q25overseas growth of4.3%YoY.

Steady growth from overseas.In2024,overseas revenue grew by21.3%YoY to RMB16.4bn,accounting for44.7%of total revenue(+6.0ppts).Ex-North America revenue rose26%YoY to RMB13.8bn,with Asia-Pacificcontinuing as the growth engine.Mindray achieved further breakthroughs inhigh-end markets,with high-end strategic customers contributing14%ofoverseas revenue.With enhanced localization and installations of high-endproducts such as the MT8000,we expect the overseas revenue to grow bya mid-teens percentage in2025E.As the US contributed only~6%ofMindray’s total revenue,the impact of trade frictions may be moderate.Diversified manufacturing across13countries and proactive inventorymanagement should help mitigate related risks.

Domestic market remained under pressure.In2024,domestic revenuedecreased by5.1%YoY to RMB20.3bn.Revenue from PMLS and MISsegments fell31%YoY and2%YoY,respectively,due to weak hospitalprocurement.According to IQVIA,China’s medical equipment marketdecreased12.3%YoY in2024.Policy headwinds including DRG2.0,inter-hospital recognition of test results,and reagent price cuts further weighedon IVD revenue.IQVIA estimated a decline in the biochemical market andflat growth in immunology market in2024.Therefore,Mindray’s domesticIVD revenue increased1%YoY in2024.However,Joinchain data shows a67.5%YoY increase in medical equipment bidding value in1Q25,indicatingpotential recovery of domestic medical equipment procurement.Weanticipate the revenue recovery will occur in2H25E,primarily due to thetime lag between the bidding process and revenue recognition.

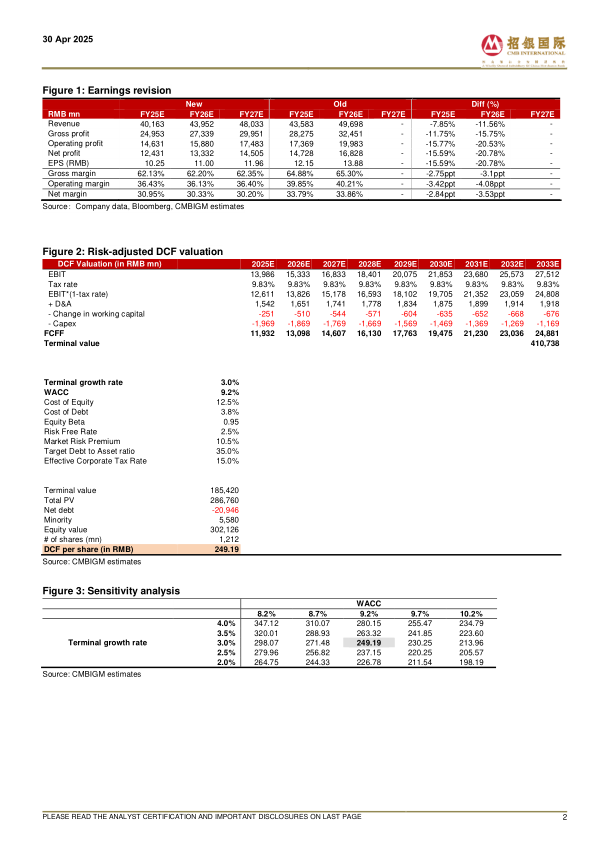

Maintain BUY.Given the uncertainties of the timeline of domesticprocurement recovery and trade frictions,we revise down our earningsforecasts.We expect revenue and attributable net profit to grow9.4%and6.5%YoY,respectively,in2025E.Based on a9-year DCF model,we adjustour TP to RMB249.19(WACC:9.2%,terminal growth rate:3.0%).

中心思想

- 国内需求复苏缓慢,海外市场稳健增长: 公司2024年业绩增长主要依赖海外市场,国内市场受政策和招标延迟影响。预计2025年海外市场仍将保持稳健增长,但国内市场复苏的时间存在不确定性。

- 盈利预测下调,目标价调整: 考虑到国内采购恢复时间的不确定性和中美贸易摩擦的影响,报告下调了盈利预测,并将目标价从RMB328.81调整至RMB249.19。维持“买入”评级。

主要内容

公司业绩回顾与展望

- 2024年业绩表现: 公司2024年收入为人民币367亿元,同比增长5.1%;归母净利润为人民币117亿元,同比增长0.7%。毛利率同比下降1.1个百分点至63.1%,主要由于IVD试剂和中低端医疗设备的价格压力,以及DRG 2.0实施后IVD检测需求的减弱。

- 2025年一季度业绩: 公司2025年一季度收入同比下降12.1%至人民币82亿元,主要由于国内收入同比下降超过20%,以及2024年一季度海外收入基数较高。

- 海外市场增长强劲: 公司2024年海外收入同比增长21.3%至人民币164亿元,占总收入的44.7%。北美收入同比增长26%至人民币138亿元,亚太地区持续成为增长引擎。高端战略客户贡献了海外收入的14%。

- 国内市场面临压力: 公司2024年国内收入同比下降5.1%至人民币203亿元。PMLS和MIS部门的收入分别下降31%和2%,主要由于医院采购疲软。政策因素,包括DRG 2.0、检测结果的医院间互认以及试剂降价,进一步对IVD收入构成压力。

盈利预测与估值

- 盈利预测调整: 报告下调了公司2025E、2026E和2027E的收入和盈利预测。预计2025年收入和归母净利润将分别增长9.4%和6.5%。

- 目标价调整: 基于9年期DCF模型,将目标价调整至RMB249.19(WACC:9.2%,永续增长率:3.0%)。

- 估值分析: 报告提供了DCF估值、敏感性分析以及与市场一致预期的对比。

财务分析

- 损益表分析: 详细列出了公司2022A至2027E的收入、成本、费用、利润等关键财务指标。

- 资产负债表分析: 详细列出了公司2022A至2027E的资产、负债和权益等关键财务指标。

- 现金流量表分析: 详细列出了公司2022A至2027E的经营活动、投资活动和融资活动的现金流量。

- 财务比率分析: 报告分析了公司的增长率、盈利能力、偿债能力和运营效率等关键财务比率。

总结

本报告对迈瑞医疗(300760 CH)进行了更新分析,指出公司在2024年面临国内市场需求疲软的挑战,但海外市场表现强劲。报告下调了公司未来的盈利预测,并相应调整了目标价格,但维持了“买入”评级。报告详细分析了公司的财务状况,包括损益表、资产负债表和现金流量表,并与市场一致预期进行了对比。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送