-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Core business growth remains solid

Core business growth remains solid

-

下载次数:

1900 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2022-10-26

-

页数:

5页

泰格医药(300347)

3Q22 earnings in line. Tigermed reported 3Q22 revenue of RMB1,812mn, up 35% YoY, attributable net income of RMB413mn, down 22% YoY, and attributable recurring net income of RMB421mn, up 29% YoY. Excluding COVID-19 revenue, we estimate 3Q22 revenue increased by c.42% YoY. The declining attributable net income in 3Q22 was mainly attributable to the fair value losses of RMB11mn, compared with fair value gains of RMB211mn in 3Q21. Gross profit margin (GPM) continuously improved to 40.9% in 3Q22 from 38.8% in 1Q22 and 40.6% in 2Q22, thanks to the shrinking size of the low-margin COVID-19 related revenue (due to pass-through revenue to sub-contractors in overseas markets) as well as the growth of US$-denominated services, such as data management and statistical analysis (DMSA) and laboratory services provided by Frontage, which benefited from US$ appreciation in 3Q22. Non-COVID-19 related new orders increased by c.35%/30% YoY in 9M22/3Q22, respectively, indicating sustainable growth of core business.

Consistently focus on high-margin business. Management has prioritized the expansion of high-margin businesses, including clinical trials operation,DMSA and some emerging services while takes a relatively conservative strategy on the SMO business given its low profitability nature. According to management, the Company has further increased its market share in China clinical CRO market for innovative drugs to c.20% in 3Q22, which represented the Company’s strong competency and high customer recognition. DMSA successfully sealed a strategic cooperation deal with a global Top10 pharma in the past quarter. Additionally, Tigermed has adopted a proactive hiring strategy and allocated more human resources to high margin business in 3Q22. We think the strategic change is critical and necessary for Tigermed to further enhance its leading position for its core business given the intensifying competition in China market in recent years.

Globalization on track. Tigermed has built local BD teams to explore business opportunities in Europe and the US. The Company has participated in large-scale Phase III multi-regional clinical trials (MRCT) in multiple middle and western European countries. The Company also took full advantages of its experiences in COVID-19 vaccine projects of Chinese clients to expand business opportunities in developing countries, including Indonesia, Brazil, Chile and Pakistan. These developing countries could be potential markets for Chinese drug makers, which will create additional demand for Tigermed’s clinical CRO services.

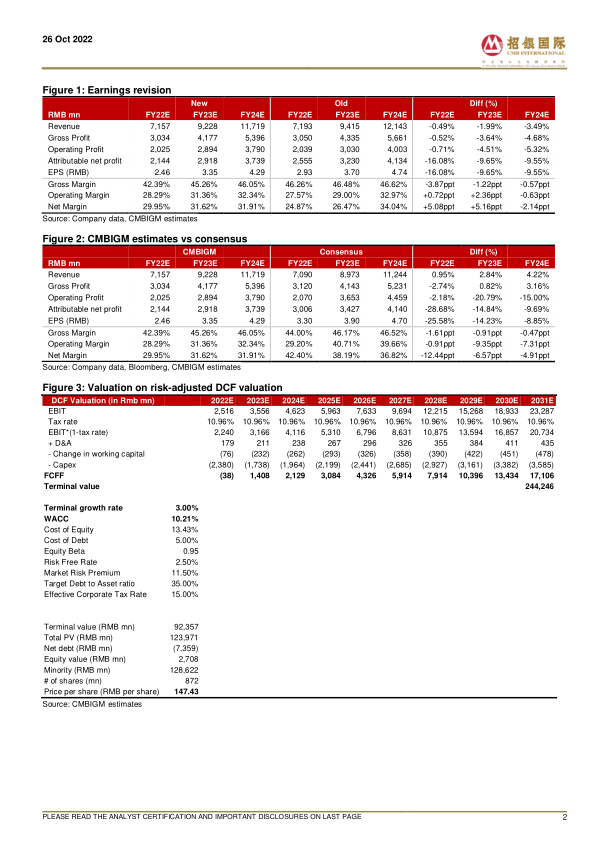

Maintain BUY. We revise our TP from RMB175.15 to RMB147.43, based on a 10-year DCF model (WACC: 10.21%, terminal growth rate: 3.0%). We forecast Tigermed’s revenue to grow 37%/29%/27% YoY and attributablerecurring net income to grow 37%/40%/31% YoY in FY22E/23E/24E.

中心思想

- 核心业务稳健增长: 剔除COVID-19相关收入后,预计第三季度收入同比增长约42%,表明核心业务具有可持续增长性。

- 战略调整提升竞争力: 公司战略性地将资源集中于高利润业务,如临床试验运营和DMSA,同时对SMO业务采取保守策略,以应对中国市场日益激烈的竞争,巩固其领先地位。

主要内容

业绩表现

- 第三季度业绩概览: 2022年第三季度,泰格医药实现收入18.12亿元人民币,同比增长35%;归母净利润4.13亿元人民币,同比下降22%;扣除COVID-19相关影响后,收入同比增长约42%。

- 毛利率持续提升: 毛利率从第一季度的38.8%持续提升至第三季度的40.9%,主要得益于低利润COVID-19相关收入占比下降以及美元计价服务的增长。

业务发展

- 新签订单增长: 2022年前三季度和第三季度,非COVID-19相关的新订单分别同比增长约35%和30%,表明核心业务具有可持续增长性。

- 市场份额扩大: 公司在中国创新药临床CRO市场的份额进一步提升至约20%,DMSA业务与全球Top10药企达成战略合作。

- 全球化战略推进: 公司在欧洲和美国建立了本地BD团队,参与了多个中西欧国家的大型III期多区域临床试验(MRCT),并利用在中国COVID-19疫苗项目中的经验,拓展在印度尼西亚、巴西、智利和巴基斯坦等发展中国家的业务机会。

财务预测与估值

- 盈利预测调整: 基于DCF模型,将目标价从175.15人民币下调至147.43人民币。

- 收入与利润增长预期: 预计2022/23/24财年收入将同比增长37%/29%/27%,归母净利润将同比增长37%/40%/31%。

总结

本报告分析了泰格医药2022年第三季度的业绩表现,指出公司核心业务保持稳健增长,并通过战略调整提升竞争力。报告强调,泰格医药在全球化战略上取得积极进展,并在高利润业务领域持续发力。基于DCF模型,报告调整了目标价,并对公司未来收入和利润增长进行了预测。总体而言,报告认为泰格医药在面临市场竞争加剧的情况下,通过优化业务结构和拓展全球市场,有望保持其行业领先地位。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送