-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Expect business rebound in 2024E

Expect business rebound in 2024E

-

下载次数:

853 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-04-02

-

页数:

6页

泰格医药(300347)

Tigermed reported 2023 revenue of RMB7,384mn, up 4.2% YoY, and attributablerecurring net income of RMB1,477mn, down 4.1% YoY. Revenue/ attributablerecurring net income missed our forecast by 2.9%/ 12.1%, respectively, mainlydue to shrinking COVID vaccine revenue, slowdown in global R&D activities,and contracted margins stemming from temporary pricing adjustments coupledby relatively lower lab facility utilization. New orders signed in 2023 amountedto RMB7.85bn, down 18.8% YoY, mainly due to ~RMB1.2bn reduction of COVIDpass-through orders. Nonetheless, the total backlog experienced a mild uptickof 2.1% YoY, reaching RMB14.1bn by the end of 2023, which provides a solidfoundation for sustainable growth. Management has observed early indicatorsof a demand resurgence and anticipates that both revenue and attributablerecurring net income will achieve mid-teen growth in 2024E, signaling a robustrecovery from the previous year.

Early signs of demand recovery. Tigermed experienced heightenedvolatility in client demand in 2023 due to subdued global biotech funding andescalating competition in the clinical CRO market. However, managementhas observed a positive shift in macro sentiment since late 2023, withbiopharmaceutical funding in China exhibiting a significant sequentialrebound. In Jan-Feb 2024, Tigermend’s new orders regained double-digitgrowth, particularly in the US and Australian markets, according to themanagement. With this trend to continue, management maintains a positiveforecast for full-year demand. Additionally, we want to highlight Tigermed’spromising growth potential in China’s market as the government persistswith its supportive policies for domestic pharmaceutical R&D.

Well-progressing globalization strategy. The challenges of the industrydid not dampen Tigermed’s commitment to globalization. Underpinned by agrowing and dedicated team of 110 PMs and CRAs, Tigermed’s US clinicaloperation saw rapid growth in revenue and backlog in 2023. Its localizedclinical operation team enables Tigermed to better capture opportunitiesfrom both Chinese pharmaceutical companies looking to enter the USmarket, as well as from US clients not fully served by global clinical CROs.Tigermed acquired a Croatia-based clinical CRO, Marti Farm, in Jan 2023,further bolstering its service capabilities in Europe. Tigermed hasestablished clinical teams in South Korea, Southeast Asia and Australia.Owing to its strong performance in the global market, Tigermed signed 15MRCT projects in 2023. We think a well-established global network will helpTigermed in mitigating potential geopolitical risks.

Maintain BUY. We revised our TP from RMB80.31 to RMB68.57, based ona 10-year DCF model (WACC: 10.95%, terminal growth: 2.0%), to factor inslower projection of revenue and recurring net income growth. We forecastTigermed’s revenue to grow 13.3%/ 17.7%/ 21.9% YoY and attributablerecurring net income to grow 14.2%/ 22.7%/ 27.4% YoY in 2024E/ 25E/ 26E,respectively.

中心思想

本报告对泰格医药(300347 CH)进行了更新,核心观点如下:

- 需求复苏迹象显现: 泰格医药观察到自2023年末以来,生物医药融资情绪明显回升,2024年1-2月新签订单恢复双位数增长,尤其是在美国和澳大利亚市场。

- 全球化战略稳步推进: 泰格医药在全球市场表现强劲,2023年签署了15个MRCT项目。公司通过收购Marti Farm等方式,不断加强在欧洲及其他地区的临床服务能力。

- 维持买入评级: 考虑到收入和经常性净利润增长预测放缓,将目标价从人民币80.31元下调至人民币68.57元,基于10年期DCF模型(WACC:10.95%,终值增长率:2.0%)。预计2024E/25E/26E收入同比增长13.3%/17.7%/21.9%,归母经常性净利润同比增长14.2%/22.7%/27.4%。

主要内容

2023年业绩回顾与展望

泰格医药2023年收入为人民币73.84亿元,同比增长4.2%;归属于母公司的经常性净利润为人民币14.77亿元,同比下降4.1%。收入和归属于母公司的经常性净利润分别低于我们预测的2.9%和12.1%,主要原因是COVID疫苗收入萎缩、全球研发活动放缓以及临时定价调整导致的利润率收缩以及实验室设施利用率相对较低。2023年新签订单金额为人民币78.5亿元,同比下降18.8%,主要原因是COVID通行订单减少约人民币12亿元。尽管如此,截至2023年底,总积压订单小幅增长2.1%,达到人民币141亿元,为可持续增长奠定了坚实的基础。管理层观察到需求复苏的早期迹象,并预计2024年收入和归属于母公司的经常性净利润都将实现两位数中段的增长,表明从前一年强劲复苏。

需求复苏的早期迹象

由于全球生物技术融资低迷以及临床CRO市场竞争加剧,泰格医药在2023年经历了客户需求的剧烈波动。然而,管理层观察到自2023年末以来宏观情绪出现积极转变,中国生物制药融资出现显着的环比反弹。管理层表示,2024年1月至2月,泰格医药的新订单恢复了两位数的增长,尤其是在美国和澳大利亚市场。随着这一趋势的持续,管理层对全年需求保持乐观预测。此外,我们想强调泰格医药在中国市场的巨大增长潜力,因为政府坚持其对国内医药研发的支持政策。

全球化战略进展顺利

行业的挑战并没有削弱泰格医药对全球化的承诺。在不断壮大且敬业的110名项目经理和CRA团队的支持下,泰格医药的美国临床业务在2023年实现了收入和积压订单的快速增长。其本地化的临床运营团队使泰格医药能够更好地抓住中国制药公司希望进入美国市场的机会,以及全球临床CRO未能充分服务的美国客户的机会。泰格医药于2023年1月收购了克罗地亚的临床CRO Marti Farm,进一步增强了其在欧洲的服务能力。泰格医药已在韩国、东南亚和澳大利亚建立了临床团队。由于其在全球市场的强劲表现,泰格医药在2023年签署了15个MRCT项目。我们认为,完善的全球网络将有助于泰格医药减轻潜在的地缘政治风险。

盈利预测与估值调整

我们将目标价从人民币80.31元调整至人民币68.57元,基于10年期DCF模型(WACC:10.95%,终值增长率:2.0%),以反映收入和经常性净利润增长的较慢预测。我们预测泰格医药的收入在2024E/25E/26E将分别同比增长13.3%/17.7%/21.9%,归属于母公司的经常性净利润将分别同比增长14.2%/22.7%/27.4%。

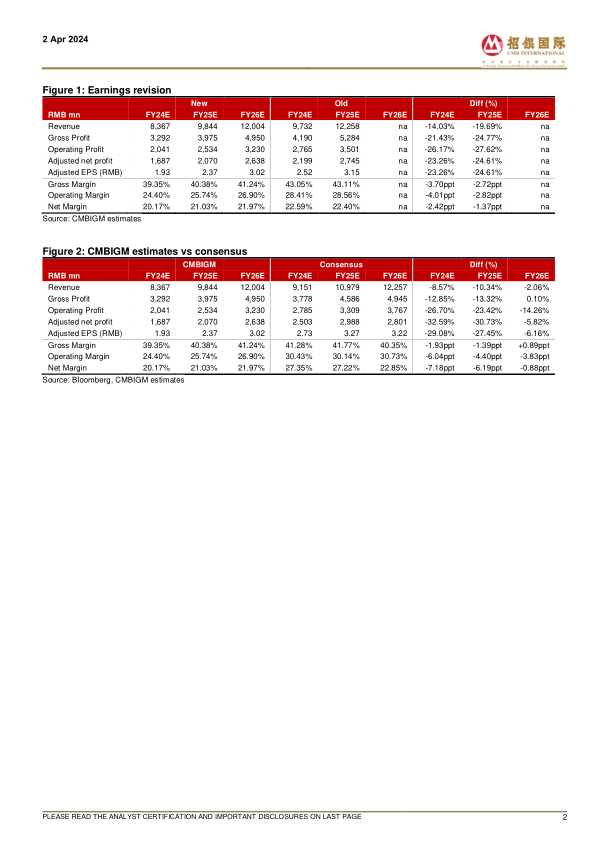

盈利预测调整

- 收入: FY24E收入从97.32亿元下调至83.67亿元,下调幅度为-14.03%;FY25E收入从122.58亿元下调至98.44亿元,下调幅度为-19.69%。

- 毛利润: FY24E毛利润从41.90亿元下调至32.92亿元,下调幅度为-21.43%;FY25E毛利润从52.84亿元下调至39.75亿元,下调幅度为-24.77%。

- 运营利润: FY24E运营利润从27.65亿元下调至20.41亿元,下调幅度为-26.17%;FY25E运营利润从35.01亿元下调至25.34亿元,下调幅度为-27.62%。

- 调整后净利润: FY24E调整后净利润从21.99亿元下调至16.87亿元,下调幅度为-23.26%;FY25E调整后净利润从27.45亿元下调至20.70亿元,下调幅度为-24.61%。

- 调整后每股收益(EPS): FY24E调整后EPS从2.52元下调至1.93元,下调幅度为-23.26%;FY25E调整后EPS从3.15元下调至2.37元,下调幅度为-24.61%。

- 毛利率: FY24E毛利率从43.05%下调至39.35%,下调幅度为-3.70个百分点;FY25E毛利率从43.11%下调至40.38%,下调幅度为-2.72个百分点。

- 运营利润率: FY24E运营利润率从28.41%下调至24.40%,下调幅度为-4.01个百分点;FY25E运营利润率从28.56%下调至25.74%,下调幅度为-2.82个百分点。

- 净利润率: FY24E净利润率从22.59%下调至20.17%,下调幅度为-2.42个百分点;FY25E净利润率从22.40%下调至21.03%,下调幅度为-1.37个百分点。

与市场一致预期的比较

- 收入: CMBIGM对FY24E、FY25E和FY26E的收入预测分别比市场一致预期低8.57%、10.34%和2.06%。

- 毛利润: CMBIGM对FY24E和FY25E的毛利润预测分别比市场一致预期低12.85%和13.32%,但FY26E的预测与市场一致预期基本持平。

- 运营利润: CMBIGM对FY24E、FY25E和FY26E的运营利润预测分别比市场一致预期低26.70%、23.42%和14.26%。

- 调整后净利润: CMBIGM对FY24E、FY25E和FY26E的调整后净利润预测分别比市场一致预期低32.59%、30.73%和5.82%。

- 调整后每股收益(EPS): CMBIGM对FY24E、FY25E和FY26E的调整后EPS预测分别比市场一致预期低29.08%、27.45%和6.16%。

- 毛利率: CMBIGM对FY24E和FY25E的毛利率预测分别比市场一致预期低1.93和1.39个百分点,但FY26E的预测比市场一致预期高0.89个百分点。

- 运营利润率: CMBIGM对FY24E、FY25E和FY26E的运营利润率预测分别比市场一致预期低6.04、4.40和3.83个百分点。

- 净利润率: CMBIGM对FY24E和FY25E的净利润率预测分别比市场一致预期低7.18和6.19个百分点,但FY26E的预测比市场一致预期低0.88个百分点。

总结

本报告分析了泰格医药2023年的业绩表现,并展望了2024年及以后的发展前景。报告强调了公司在全球化战略方面的进展,以及需求复苏的早期迹象。尽管下调了盈利预测和目标价,但维持了“买入”评级,反映了对公司长期增长潜力的信心。报告还对比了CMBIGM的预测与市场一致预期,为投资者提供了更全面的信息。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送