-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Rising demand for small molecule D&M business

Rising demand for small molecule D&M business

-

下载次数:

448 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-10-28

-

页数:

6页

药明康德(603259)

WuXi AppTec reported strong 3Q25 results, with revenue increasing by 15.3%YoY (including 19.7% YoY growth for continuing operations) and adj. non-IFRSnet profit surging by 42.0% YoY. Revenue from continuing operations in 9M25accounted for 73.8% of our full-year forecast, in line with historical average of72%, while adj. non-IFRS net profit in 9M25 represented 85.7% of our full-yearforecast, significant higher than the historical average of 72%. WuXi AppTecdelivered strong operational execution, despite ongoing macro uncertainties. Assuch, mgmt. further raised its full-year guidance for 2025, expecting total revenueto be RMB43.5-44.0bn (previously: RMB42.5-43.5bn) with revenue fromcontinuing operations to grow by 17-18% (previously: 13-17%). Mgmt. continuedto expect adj. non-IFRS net profit margin to expand in 2025.

Encouraging demand growth in small molecule D&M business. As ofSept 2025, WuXi AppTec’s backlog from continuing operations reached RMB59.88bn with a strong YoY growth of 41.2%, accelerated from 37.2% YoY asof Jun 2025. In contrast, backlog for TIDES services grew by 17.1% YoY asat end-Sept 2025, slowing from 48.8% YoY seen as at end-Jun 2025. Thedivergence underscored the small molecule D&M business as a primarygrowth driver for backlog in 3Q25. With that, mgmt. expected acceleratedrevenue growth for this segment in 2026. Mgmt. noted that the Company’spipeline included multiple promising products targeting areas such as GLP-1, PCSK9, pain, neurology, and autoimmune diseases. Given that smallmolecule D&M accounted for 46% of total revenue in 2024, we believe it willbecome a key driver for the Company’s overall growth. To meet the risingcustomer demand, WuXi AppTec is actively expanding manufacturingcapacity in China, Singapore, the US, and Switzerland.

Early-stage demand showing more signs of recovery, though a fullrebound will take time. In the Chemistry segment, revenue from drugdiscovery services declined 2.0% YoY in 3Q25, though sequential QoQimprovements were seen. Notably, the safety assessment services posted5.9% YoY and 13.2% QoQ revenue growth in 3Q25, a significant reboundfrom the 7.8% decline in 2Q25, suggesting a recovery in client demand andimproved pricing dynamics. Within the Biology segment, revenue grew 5.9%YoY in the quarter, consistent with the pace observed in 1H25. Mgmt.indicated that early signs of demand recovery are emerging, supported by arebound in China’s capital markets, robust global BD activity, and US interestrate cuts. However, a broad-based industry recovery will still take time. Giventhe high sensitivity to macroeconomic conditions, we believe early-stagebusinesses within WuXi AppTec should have relatively high visibility over thenext two years, as market conditions normalize.

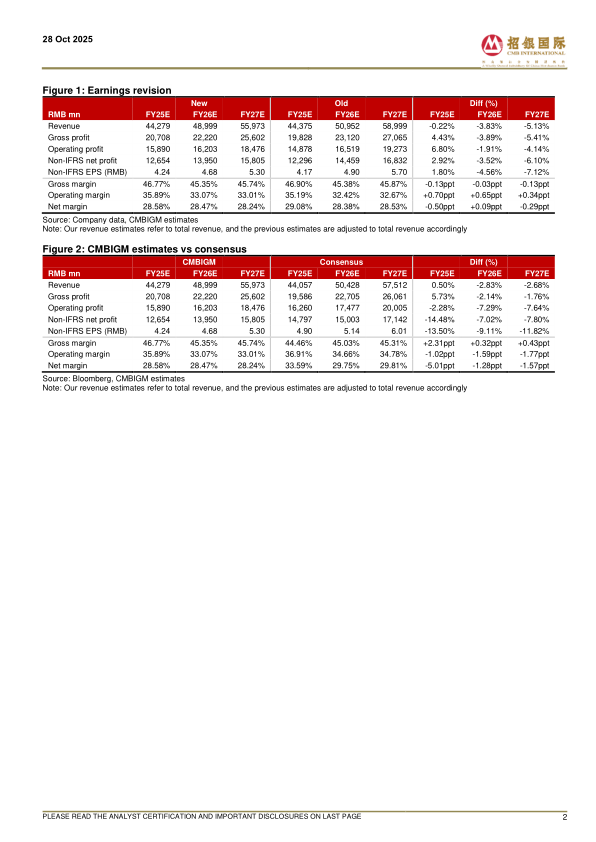

Maintain BUY. We raise our DCF-based TP from RMB118.79 to RMB123.35(WACC: 9.39%, terminal growth: 2.00%; both unchanged), to factor in ourimproved outlook on the macro environment. We now expect revenue to growby 12.8%/ 10.7%/ 14.2% YoY (for continuing operations: 18.0%/ 15.0%/14.2% YoY) and adjusted non-IFRS net profit to grow by 19.6%/ 10.2%/13.3% YoY in 2025E/ 26E/ 27E, respectively.

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Impressive growth amid uncertain environment

-

Awaiting domestic demand rebound

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送