-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Overseas strength offsets domestic softness

Overseas strength offsets domestic softness

-

下载次数:

1721 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2025-10-31

-

页数:

6页

迈瑞医疗(300760)

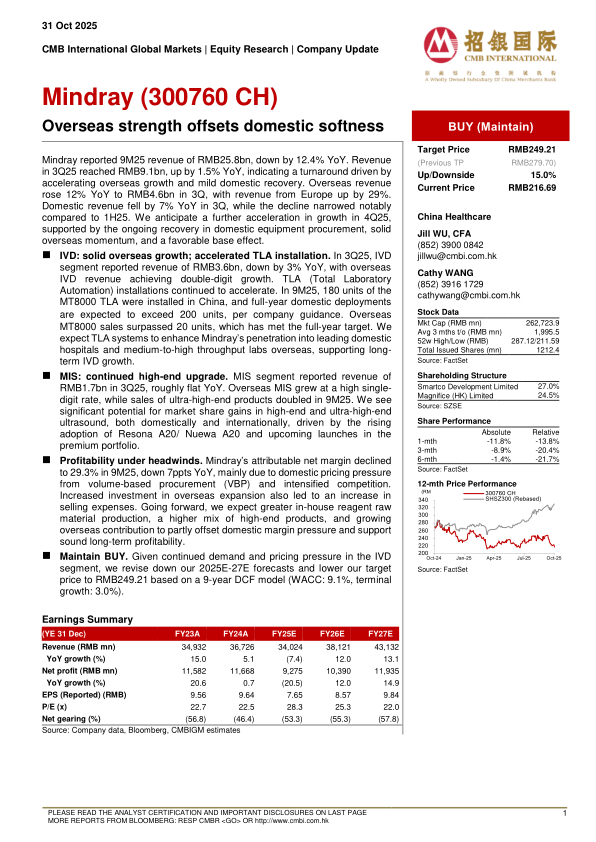

Mindray reported9M25revenue of RMB25.8bn,down by12.4%YoY.Revenuein3Q25reached RMB9.1bn,up by1.5%YoY,indicating a turnaround driven byaccelerating overseas growth and mild domestic recovery.Overseas revenuerose12%YoY to RMB4.6bn in3Q,with revenue from Europe up by29%.Domestic revenue fell by7%YoY in3Q,while the decline narrowed notablycompared to1H25.We anticipate a further acceleration in growth in4Q25,supported by the ongoing recovery in domestic equipment procurement,solidoverseas momentum,and a favorable base effect.

IVD:solid overseas growth;accelerated TLA installation.In3Q25,IVDsegment reported revenue of RMB3.6bn,down by3%YoY,with overseasIVD revenue achieving double-digit growth.TLA(Total LaboratoryAutomation)installations continued to accelerate.In9M25,180units of theMT8000TLA were installed in China,and full-year domestic deploymentsare expected to exceed200units,per company guidance.OverseasMT8000sales surpassed20units,which has met the full-year target.Weexpect TLA systems to enhance Mindray’s penetration into leading domestichospitals and medium-to-high throughput labs overseas,supporting long-term IVD growth.

MIS:continued high-end upgrade.MIS segment reported revenue ofRMB1.7bn in3Q25,roughly flat YoY.Overseas MIS grew at a high single-digit rate,while sales of ultra-high-end products doubled in9M25.We seesignificant potential for market share gains in high-end and ultra-high-endultrasound,both domestically and internationally,driven by the risingadoption of Resona A20/Nuewa A20and upcoming launches in thepremium portfolio.

Profitability under headwinds.Mindray’s attributable net margin declinedto29.3%in9M25,down7ppts YoY,mainly due to domestic pricing pressurefrom volume-based procurement(VBP)and intensified competition.Increased investment in overseas expansion also led to an increase inselling expenses.Going forward,we expect greater in-house reagent rawmaterial production,a higher mix of high-end products,and growingoverseas contribution to partly offset domestic margin pressure and supportsound long-term profitability.

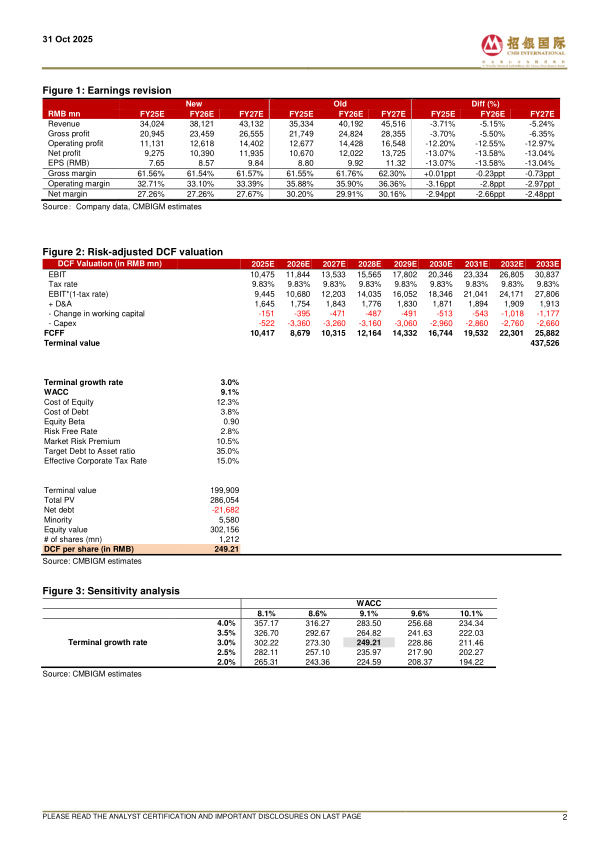

Maintain BUY.Given continued demand and pricing pressure in the IVDsegment,we revise down our2025E-27E forecasts and lower our targetprice to RMB249.21based on a9-year DCF model(WACC:9.1%,terminalgrowth:3.0%).

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

-

Awaiting domestic demand rebound

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送