-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Impressive order growth despite geopolitical uncertainties

Impressive order growth despite geopolitical uncertainties

-

下载次数:

2007 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-07-31

-

页数:

6页

药明康德(603259)

WuXi AppTec reported 1H24 revenue of RMB17.24bn, down 8.6% YoY,attributable recurring net profit of RMB4.41bn, down 8.3% YoY, and attributableadjusted non-IFRS net profit of RMB4.37bn, down 14.2% YoY. 1H24 revenue /attributable adjusted non-IFRS net income accounted for 45.3%/ 46.0% of our2024 full-year estimates and 43.8%/ 44.7% of Bloomberg consensus, both ofwhich were largely in line with its historical range. The non-COVID D&M revenue(within the Chemistry segment) experienced a slight decline of 2.7% YoY in1H24, following a relatively high base in 1H23. Notably, WuXi AppTec’s backlog,excluding COVID-19 commercial projects, increased by 33.2% YoY in 1H24,indicating strong customer demand amid geopolitical uncertainties. Mgt. hasreiterated its revenue guidance of RMB38.3-40.5bn for 2024, forecasting YoYgrowth of 2.7% to 8.6% for revenues excluding COVID-19 commercial projects.Mgt. expects the adjusted non-IFRS net profit margin to align with the 2023level.

Impressive order growth driven by solid demand. As of June 2024, WuXiAppTec's backlog reached RMB43.1bn, marking a robust YoY increase of33.2% excluding COVID-19 commercial projects. Revenue from its globalTop20 pharmaceutical clients reached RMB6.59bn, contributing 38.2% ofthe total revenue and increasing by 11.9% YoY excluding COVID-19commercial projects. Mgt. highlighted that over 80% of the backlog wasexpected to convert into revenue within the next 18 months, which shouldalleviate market concerns about clients' early bookings due to geopoliticalconsiderations (with the ATU segment being an exception). Additionally,mgt. indicated that new orders signed in 1H24 increased by ~25% YoY. Thestrong order growth demonstrates the resilient demand for WuXi AppTec'shigh-quality services, indicating a positive outlook for FY25 growth.

TIDES business continued to be a major growth engine. Revenue ofTIDES business reached RMB2.08bn in 1H24, demonstrating robust YoYgrowth of 57.2%, following a significant 64.4% YoY increase in 2023. As ofJune 2024, the TIDES backlog grew substantially by 147% YoY. In January2024, the Company’s new peptide production facilities commencedoperation, which expanded its total capacity to 32,000 liters, positioning theCompany as a leader in global TIDES CDMO. With the robust backlog andreadily available production capacity, mgt. expects TIDES revenue to growby over 60% YoY in 2024 and to maintain the strong momentum in 2025.Our model projects TIDES revenue to exceed RMB8.6bn in 2025,contributing ~20% to WuXi AppTec’s total revenue, a significant increasefrom ~4% in 2022.

Maintain BUY. Factoring in the positive trend of customer demand, we liftour TP from RMB53.23 to RMB54.27 (based on a 10-year DCF model withWACC of 10.38% and terminal growth of 2.0%). We forecast revenue togrow by -4.4%/ +10.9%/ +10.8% YoY and adjusted non-IFRS net income togrow by -8.3%/ +11.6%/ +12.1% YoY in 2024E/ 25E/ 26E, respectively

中心思想

本报告对药明康德(603259 CH)进行了更新,核心观点如下:

- 订单增长强劲,需求韧性凸显: 尽管面临地缘政治不确定性,药明康德的订单依然实现了显著增长,表明客户对其高质量服务的需求依然强劲,为2025财年的增长奠定了积极的基础。

- TIDES业务成为增长引擎: TIDES业务持续高速增长,积压订单大幅增加,产能扩张顺利,预计未来将为公司贡献显著的收入增长。

主要内容

公司业绩回顾:2024年上半年业绩表现

药明康德公布了2024年上半年的业绩,收入同比下降8.6%至人民币172.4亿元,归属于公司股东的经常性净利润同比下降8.3%至人民币44.1亿元,归属于公司股东的经调整非IFRS净利润同比下降14.2%至人民币43.7亿元。剔除新冠商业项目,非新冠D&M收入(化学业务分部)同比小幅下降2.7%。

订单增长分析:强劲的客户需求

截至2024年6月,药明康德的积压订单达到人民币431亿元,不包括新冠商业项目,同比增长33.2%。全球前20大制药客户的收入达到人民币65.9亿元,占总收入的38.2%,不包括新冠商业项目,同比增长11.9%。管理层强调,超过80%的积压订单预计在未来18个月内转化为收入。2024年上半年签订的新订单同比增长约25%。

TIDES业务分析:主要增长引擎

TIDES业务在2024年上半年实现收入人民币20.8亿元,同比增长57.2%,2023年同比增长64.4%。截至2024年6月,TIDES积压订单大幅增长147%。2024年1月,公司新的肽生产设施开始运营,总产能扩大至32,000升,巩固了公司在全球TIDES CDMO领域的领导地位。管理层预计TIDES收入在2024年将同比增长超过60%,并在2025年保持强劲势头。

盈利预测及估值:维持买入评级

考虑到客户需求的积极趋势,将目标价从人民币53.23元上调至人民币54.27元(基于10年期DCF模型,WACC为10.38%,永续增长率为2.0%)。预计2024E/25E/26E收入将分别同比增长-4.4%/+10.9%/+10.8%,调整后非IFRS净利润将分别同比增长-8.3%/+11.6%/+12.1%。

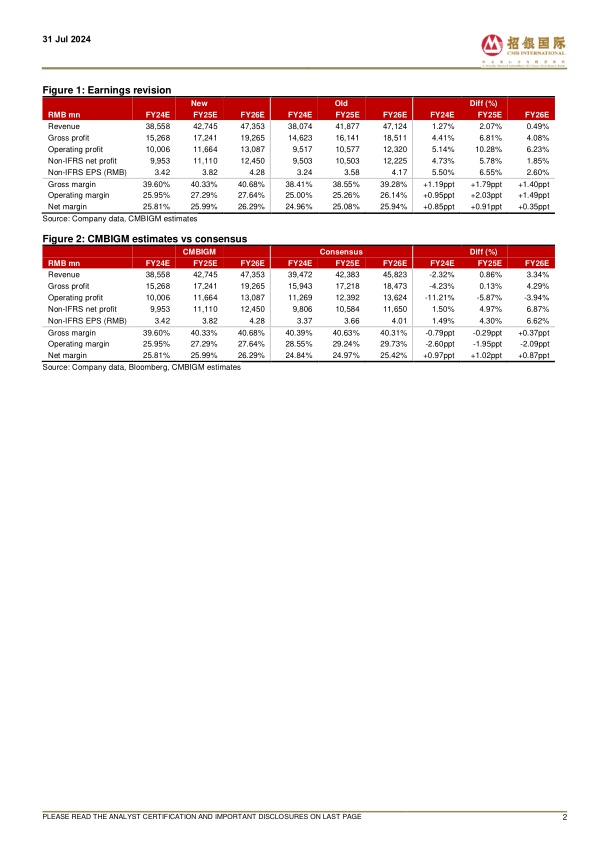

盈利预测调整:上调盈利预测

对盈利预测进行了调整,具体见下图:

- Figure 1: Earnings revision

- Figure 2: CMBIGM estimates vs consensus

估值分析:DCF估值模型

使用风险调整后的DCF估值模型,得出目标价为人民币54.27元。

- Figure 3: Valuation on risk-adjusted DCF valuation

- Figure 4: Sensitivity analysis of DCF model

总结

本报告强调了药明康德在面对地缘政治不确定性时所展现出的强劲订单增长和客户需求韧性。TIDES业务作为主要增长引擎,其高速增长和产能扩张为公司未来的收入增长提供了有力支撑。维持“买入”评级,并将目标价上调至人民币54.27元,反映了对公司未来增长潜力的信心。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送