-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Expect domestic business to rebound from 2025

Expect domestic business to rebound from 2025

-

下载次数:

702 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-10-31

-

页数:

6页

迈瑞医疗(300760)

Mindray reported9M24revenue of RMB29.5bn,up by8.0%YoY.Attributable netprofit increased by8.2%YoY to RMB10.6bn.Revenue in3Q24grew by1.4%YoY to RMB9.0bn while attributable net profit decreased by9.3%YoY toRMB3.1bn.The slowdown in revenue growth can primarily be attributed tolackluster procurement activities in domestic public hospitals and weakeneddemand for IVD testing,particularly in lower-tier hospitals.Consequently,Mindray's domestic revenue fell by9.7%YoY in3Q24.Additionally,GPM in3Q24decreased by4.8pcts QoQ due to updates in accounting guidelines.

Domestic market remained under pressure,although signs of recoveryin procurement are emerging.1)IVD:Domestic revenue grew by17%YoYin9M24.Nationwide DRG implementation had a negative impact on thediagnosis demand in lower-tier hospitals which were the main contributors toMindray's domestic IVD revenue.To counter act this,Mindray activelyexpanded its IVD business into top hospitals through its TLA and IT solutions.We expect Mindray to install over150TLAs in2024E.2)MIS:Domesticrevenue grew by over10%YoY in9M24driven by the strong volume ramp-up of ultra-high-end Resona A20ultrasound system.3)PMLS:Domesticrevenue decreased by28%YoY in9M24.The decline was influenced by

environment.However,with accelerated issuance of special bonds,andstronger government support to address local debt issues,we expectdomestic equipment demand to recover in2025E.

Healthy growth in overseas business.In3Q24,Mindray’s overseasrevenue increased by18.6%YoY with strong performances in Europe(+29%YoY),APAC(+32%YoY)and LatAm(+25%YoY),although there was someweakness in the US market.Driven by breakthroughs in medium-to-largevolume labs,Mindray’s overseas IVD revenue increased by32%YoY in9M24,accounting for28%of total overseas revenue.Mindray hasaccelerated its overseas localization efforts.As of3Q24,Mindray launchedlocal manufacturing in9countries,8of which are related to IVD.Additionally,emerging businesses such as minimally invasive surgery(+50+%YoY),AED(+50+%YoY)and animal medical(+30+%YoY)grew significantly in9M24.These emerging businesses contributed over10%to Mindray’s overseasrevenue.We expect IVD and emerging businesses to become the primarygrowth drivers for Mindray’s overseas businesses.

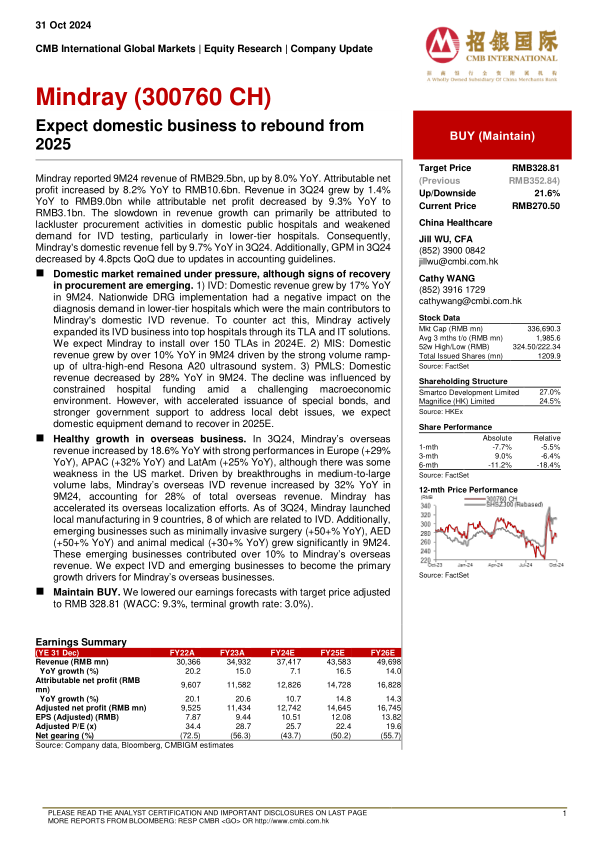

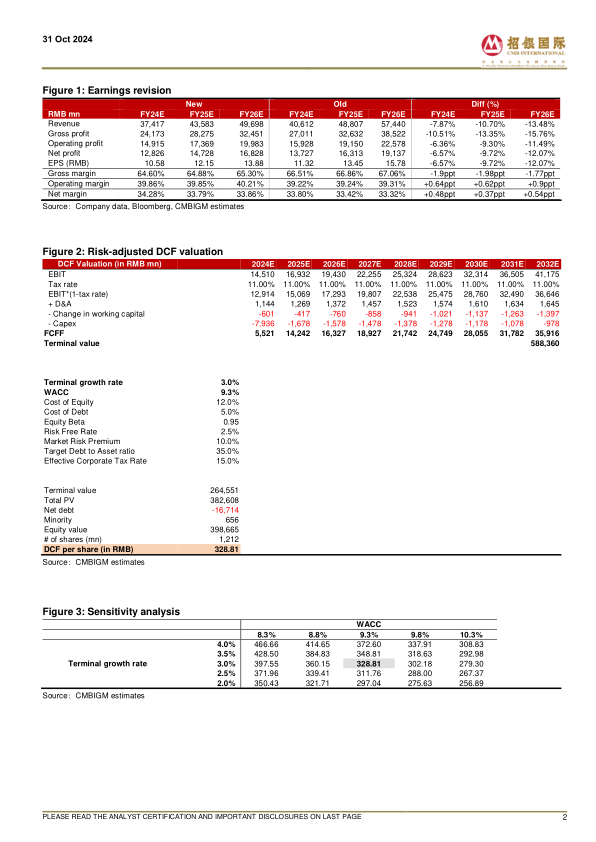

Maintain BUY.We lowered our earnings forecasts with target price adjustedto RMB328.81(WACC:9.3%,terminal growth rate:3.0%).

中心思想

本报告对迈瑞医疗(300760 CH)进行了更新,核心观点如下:

- 国内业务有望在2025年反弹: 尽管国内公共医院的采购活动低迷以及IVD检测需求减弱导致近期国内收入下降,但随着专项债的加速发行和政府对地方债务问题的支持,预计国内设备需求将在2025年恢复。

- 维持买入评级,下调目标价: 考虑到盈利预测的调整,将目标价从RMB352.84下调至RMB328.81,但维持买入评级。

主要内容

公司业绩回顾:9M24业绩及3Q24增速放缓

迈瑞医疗公布了9M24的收入为人民币295亿元,同比增长8.0%。归属于母公司的净利润增长8.2%至人民币106亿元。然而,3Q24的收入同比增长放缓至1.4%,为人民币90亿元,归属于母公司的净利润同比下降9.3%至人民币31亿元。收入增长放缓主要归因于国内公立医院采购活动不活跃,以及中国医疗对IVD检测的需求减弱,尤其是在下级医院。因此,迈瑞医疗3Q24的国内收入同比下降9.7%。此外,由于会计准则的更新,3Q24的毛利率环比下降4.8个百分点。

国内市场承压但显复苏迹象

- IVD业务: 9M24国内收入同比增长17%。全国范围内的DRG实施对下级医院的诊断需求产生了负面影响,而这些医院是迈瑞医疗国内IVD收入的主要贡献者。为了应对这种情况,迈瑞医疗通过其TLA和IT解决方案积极将其IVD业务扩展到顶级医院。预计迈瑞医疗将在2024年安装超过150个TLA。

- MIS(医疗影像系统): 在超高端Resona A20超声系统的强劲销量推动下,9M24国内收入同比增长超过10%。

- PMLS(患者监护与生命支持): 9M24国内收入同比下降28%。下降受到宏观经济环境充满挑战的情况下医院资金受限的影响。

海外业务健康增长

3Q24迈瑞医疗的海外收入同比增长18.6%,欧洲(同比增长29%)、亚太地区(同比增长32%)和拉丁美洲(同比增长25%)表现强劲,但美国市场出现了一些疲软。在中大型实验室取得突破的推动下,迈瑞医疗的海外IVD收入在9M24同比增长32%,占海外总收入的28%。迈瑞医疗加速了其海外本地化工作。截至3Q24,迈瑞医疗在9个国家启动了本地制造,其中8个与IVD相关。此外,微创外科(同比增长50%以上)、AED(同比增长50%以上)和动物医疗(同比增长30%以上)等新兴业务在9M24中显着增长。这些新兴业务贡献了迈瑞医疗海外收入的10%以上。预计IVD和新兴业务将成为迈瑞医疗海外业务的主要增长动力。

盈利预测调整

下调了盈利预测,并将目标价格调整为人民币328.81元(WACC:9.3%,终端增长率:3.0%)。

总结

本报告分析了迈瑞医疗9M24的业绩,指出国内市场面临压力但显现复苏迹象,海外业务保持健康增长。尽管由于国内采购活动低迷和IVD需求减弱导致近期业绩增速放缓,但预计2025年国内业务将迎来反弹。报告维持对迈瑞医疗的买入评级,但根据盈利预测的调整,下调了目标价格至人民币328.81元。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送