-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Earnings recovery underway

Earnings recovery underway

-

下载次数:

910 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-10-30

-

页数:

6页

药明康德(603259)

WuXi AppTec reported 3Q24 revenue of RMB10.46bn, slightly down 2.0% YoY,and attributable adjusted non-IFRS net profit of RMB2.97bn, down 3.2% YoY.Total non-COVID revenue and non-COVID Chemistry revenue growth reboundedto 14.6% YoY and 26.4% YoY, respectively, in 3Q24. Despite the challenginggeopolitical environment, mgmt. reiterated its revenue guidance of RMB38.3-40.5bn for 2024, indicating 2.7%~8.6% YoY non-COVID revenue growth.Additionally, mgmt. reiterated its commitment to maintaining an adjusted nonIFRS net profit margin consistent with the levels achieved in 2023.

Strong global competitiveness led to fast order growth. As of 3Q24, WuXiAppTec's backlog climbed to RMB43.82bn, representing a YoY increase of35.3%, maintaining the encouraging momentum of 33.2% YoY growth(excluding COVID-19 commercial projects) in 1H24. The rapid backloggrowth signified the enduring trust that global clients place in WuXi AppTec'shigh-quality and efficient services. This is further evidenced by a robust 23.1%YoY rise in revenues from global Top 20 pharmaceutical companies in 9M24,a notable acceleration from the 11.9% growth observed in 1H24.Management has indicated that 80% of the backlog is expected to convertinto revenue within the next 12 to 18 months, providing strong earningsvisibility for WuXi AppTec in 4Q24 and throughout 2025, in our view.

TIDES continues to exhibit strong growth. TIDES revenue grew by 71.0%YoY in 9M24, with the growth accelerating to 98.6% YoY in 3Q24. The TIDESbacklog as of 3Q24 saw a substantial YoY increase of 196%. In Jan 2024,WuXi AppTec expanded its peptide production capacity from 10k liters to 32kliters, with plans to expand to 41k liters by the end of 2024 and further to 100kliters by 2025. This ambitious expansion underscores WuXi AppTec'scommitment to meeting the rapidly growing global demand for peptideservices, positioning TIDES as the strongest growth driver for the Companythrough 2026.

Overseas peers struggle to compete with Chinese chemical CDMOs inthe medium term. In our in-depth report published on 21 Oct 2024, weanalyzed the business fundamentals of 30 companies from Europe, the US,and India engaged in API and chemical CDMO services. The findings revealthat these companies significantly trail WuXi AppTec in terms of businessscale and capacity. Specifically, most Indian peers primarily offer bulk andspecialty APIs, with limited capabilities in supporting innovative drugs R&D.Meanwhile, European firms, despite having an established pharmaceuticalmanufacturing base with several well-known chemical CDMOs, tend to focusmore on formulation instead of API. Their manufacturing sites, primarilylocated in Central and Western Europe, face higher labor costs compared toWuXi AppTec, further disadvantaging them in the competitive market.

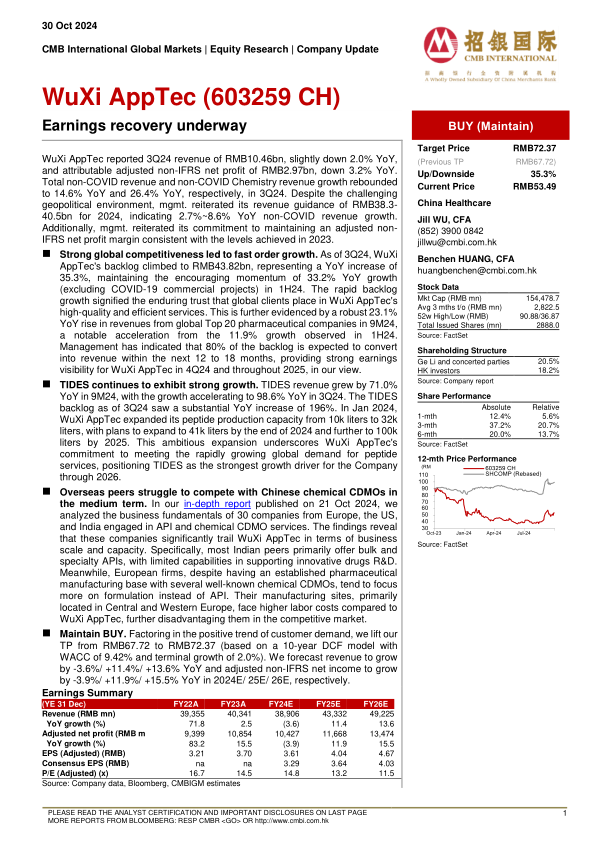

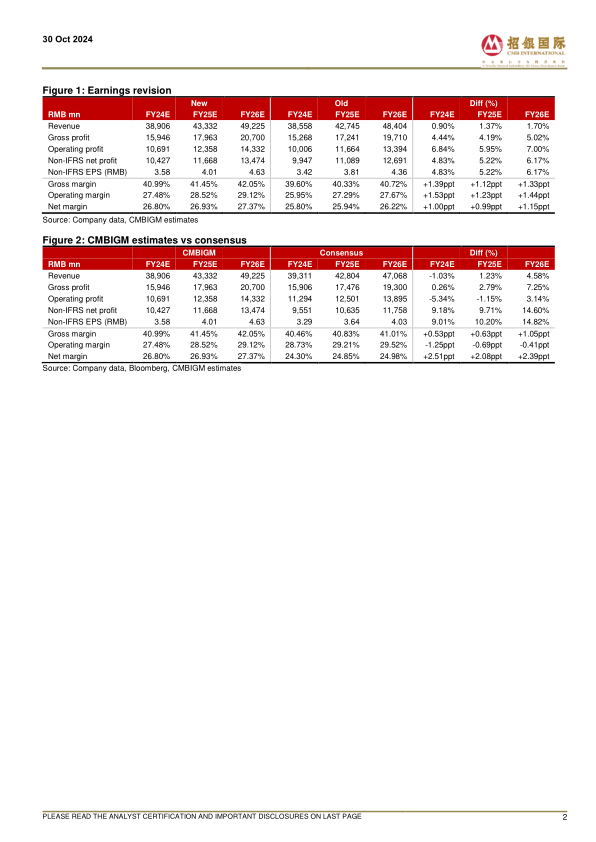

Maintain BUY. Factoring in the positive trend of customer demand, we lift ourTP from RMB67.72 to RMB72.37 (based on a 10-year DCF model withWACC of 9.42% and terminal growth of 2.0%). We forecast revenue to growby -3.6%/ +11.4%/ +13.6% YoY and adjusted non-IFRS net income to growby -3.9%/ +11.9%/ +15.5% YoY in 2024E/ 25E/ 26E, respectively.

中心思想

本报告对药明康德(603259 CH)进行了更新,核心观点如下:

- 盈利复苏趋势确立: 药明康德3Q24业绩略有下滑,但非新冠业务收入增长强劲反弹,管理层重申全年收入指引,表明公司盈利正在复苏。

- 全球竞争力驱动订单增长: 公司在手订单充足,积压订单同比增长显著,显示全球客户对公司高质量、高效率服务的持续信任。

- TIDES业务成为增长引擎: TIDES业务收入和订单大幅增长,产能扩张计划积极,有望成为公司未来增长的主要驱动力。

- 维持买入评级: 考虑到客户需求的积极趋势,上调目标价至人民币72.37元,基于DCF模型,预测未来三年收入和净利润将实现稳健增长。

主要内容

3Q24 业绩回顾

- 药明康德3Q24收入为人民币104.6亿元,同比下降2.0%;经调整非IFRS归母净利润为人民币29.7亿元,同比下降3.2%。

- 非新冠业务总收入和非新冠化学业务收入在3Q24分别同比增长14.6%和26.4%,实现反弹。

- 管理层重申2024年收入指引为人民币383-405亿元,意味着非新冠业务收入同比增长2.7%~8.6%。

- 管理层还重申,将保持与2023年持平的经调整非IFRS归母净利润率。

订单增长与全球竞争力

- 截至3Q24,药明康德的积压订单增至人民币438.2亿元,同比增长35.3%,延续了1H24的增长势头(不包括新冠商业化项目)。

- 全球Top 20制药公司在9M24的收入同比增长23.1%,较1H24的11.9%显著加速。

- 管理层表示,预计80%的积压订单将在未来12至18个月内转化为收入,为公司4Q24及2025年的盈利提供强劲支撑。

TIDES 业务的强劲增长

- TIDES业务在9M24的收入同比增长71.0%,3Q24增速加快至98.6%。

- 截至3Q24,TIDES业务的积压订单同比增长196%。

- 药明康德已将其肽生产能力从1万升扩大到3.2万升,并计划在2024年底前扩大到4.1万升,到2025年进一步扩大到10万升。

海外竞争对手分析

- 对欧洲、美国和印度的30家API和化学CDMO公司的业务基本面进行了深入分析。

- 结果显示,这些公司在业务规模和产能方面明显落后于药明康德。

- 印度同行主要提供大宗和特种API,支持创新药物研发的能力有限。

- 欧洲公司更侧重于制剂而非API,且由于劳动力成本较高,在竞争中处于劣势。

盈利预测与估值

- 将目标价从人民币67.72元上调至人民币72.37元(基于10年期DCF模型,WACC为9.42%,终值增长率为2.0%)。

- 预测2024E/25E/26E收入分别同比增长-3.6%/+11.4%/+13.6%,经调整非IFRS净利润分别同比增长-3.9%/+11.9%/+15.5%。

总结

本报告肯定了药明康德的盈利复苏趋势和全球竞争力,积压订单充足,TIDES业务增长强劲,海外竞争对手短期内难以构成威胁。维持“买入”评级,并上调目标价至人民币72.37元,反映了对公司未来增长潜力的信心。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送