-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Robust performance in a challenging industry environment

Robust performance in a challenging industry environment

-

下载次数:

2604 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-09-04

-

页数:

6页

迈瑞医疗(300760)

Mindray achieved a revenue of RMB20.5bn in 1H24, marking an 11.1% increaseYoY, and reported an attributable net profit of RMB7.6bn, up 17.4% YoY. Despite theongoing regulatory adjustments in the healthcare industry and the delay in medicalequipment renewals projects, which have led to a cautious approach towards biddingand procurement activities in public hospitals, the revenue from domestic equipmentbusiness decreased by 12% YoY. However, thanks to the rapid growth of the IVDbusiness and the domestic high-end/ultra-high-end ultrasound business, Mindray stilldemonstrated strong resilience and steady growth. The increase in the revenue sharefrom IVD reagents and high-end ultrasounds drove the Company's gross margin upby 0.7 ppt YoY to 66.3% in 1H24. Additionally, Mindray announced a mid-termdividend plan, distributing a total cash dividend of approximately RMB4.9bn, whichrepresents a payout ratio of more than 65%, indicating an ongoing increase in thedividend payout.

Domestic equipment business faces pressure. In 1H24, the continued delayin bidding and procurement activities led to a 12% YoY decrease in revenue fromdomestic equipment business. Due to the high market share of Mindray's PatientMonitoring and Life Support (PMLS) products in China, the domestic businesswas significantly affected by the industry environment, with the PMLS segmentexperiencing a 7.6% YoY decrease in revenue, including about a 20% drop indomestic revenue. The Medical Imaging segment benefited from the volumeincrease of the first domestic ultra-high-end ultrasound Resona A20 and otherhigh-end ultrasounds, resulting in a 15.5% YoY revenue growth in this segment,with high-end and ultra-high-end ultrasound revenues increasing by over 40%.

Accelerating the shift towards consumables-related business. In 1H24, theIVD reagent business was minimally affected by domestic industry regulation,with revenue increasing by 28% YoY to RMB7.7bn, accounting for over 37% oftotal revenue. Domestic IVD revenue grew by over 25%, and domestic reagentrevenue increased by 30%, with reagent revenue representing over 80% ofdomestic IVD revenue. Internationally, Mindray successfully penetrated over 60overseas third-party chain laboratories in 1H24 and installed the first MT 8000TLA, driving a more than 30% YoY increase in overseas IVD revenue. We believethat the continuous increase in domestic diagnostic demand and theimplementation of IVD VBP are expected to help Mindray rapidly expand itsdomestic market share, while accelerated cooperation with high-end clients willsupport long-term rapid growth of the IVD overseas market. Additionally, theminimally invasive surgery business grew by 90% YoY in 1H24. The Company’sacquisition of APT Medical also filled the gap in its cardiovascular consumablesbusiness. Currently, consumables-related businesses led by IVD already accountfor over 50% of the Company’s domestic revenue.

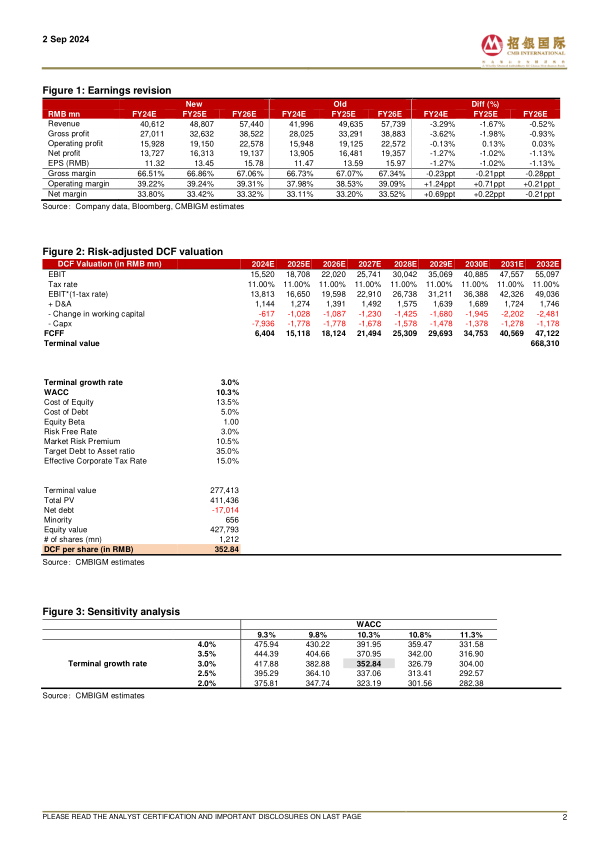

Maintain BUY. We believe that industry regulation has not affected the essentialdemand for hospital procurement. As industry regulation becomes normalizedand equipment renewal policies are implemented, hospital procurement isexpected to gradually recover. Based on a 9-year DCF model, we adjust thetarget price to RMB 352.84 (WACC: 10.3%, perpetual growth rate: 3.0%).

中心思想

- 业绩稳健增长: 迈瑞医疗在2024年上半年实现了营收和净利润的双增长,尽管面临医疗行业监管调整和医疗设备更新项目延迟等挑战,但依然展现出强大的韧性和增长潜力。

- 业务结构优化: 公司加速向耗材相关业务转型,IVD 试剂业务快速增长,成为重要的收入来源。同时,高端超声业务和微创外科业务也表现出色,推动了公司整体盈利能力的提升。

主要内容

公司业绩表现

- 营收与利润增长: 2024年上半年,迈瑞医疗实现营收205亿元人民币,同比增长11.1%;归母净利润76亿元人民币,同比增长17.4%。

- 毛利率提升: IVD 试剂和高端超声收入占比提升,推动公司毛利率同比增长0.7个百分点至66.3%。

国内业务面临的挑战与机遇

- 国内设备业务承压: 受招标采购活动延迟影响,国内设备业务收入同比下降12%。其中,由于迈瑞在患者监护和生命支持(PMLS)产品领域市场份额较高,该业务受行业环境影响显著,收入同比下降7.6%,国内收入下降约20%。

- 高端超声业务增长: 医疗影像业务受益于首台国产超高端 Resona A20 和其他高端超声的销量增长,收入同比增长15.5%,其中高端和超高端超声收入增长超过40%。

业务转型与增长点

- IVD 试剂业务加速增长: IVD 试剂业务受国内行业监管影响较小,收入同比增长28%至77亿元人民币,占总收入的37%以上。国内 IVD 收入增长超过25%,国内试剂收入增长30%,试剂收入占国内 IVD 收入的80%以上。

- 海外市场拓展: 在国际市场,迈瑞成功渗透超过60家海外第三方连锁实验室,并安装了首台 MT 8000 TLA,推动海外 IVD 收入同比增长超过30%。

- 耗材业务占比提升: 微创外科业务同比增长90%。公司收购的 APT Medical 填补了其在心血管耗材业务方面的空白。目前,以 IVD 为首的耗材相关业务已占公司国内收入的50%以上。

盈利预测与估值

- 维持买入评级: 认为行业监管并未影响医院采购的根本需求。随着行业监管常态化和设备更新政策的实施,预计医院采购将逐步恢复。

- 目标价调整: 基于9年期 DCF 模型,将目标价调整至352.84元人民币(WACC:10.3%,永续增长率:3.0%)。

财务数据分析

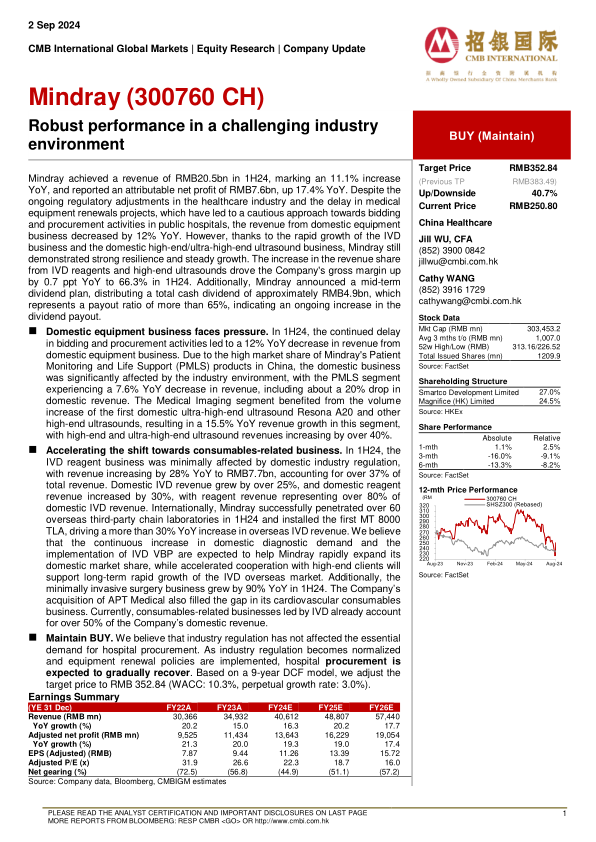

- 盈利预测调整: 对2024-2026年的营收、毛利润和净利润进行了小幅下调,但对运营利润率进行了上调。

- DCF 估值: 通过 DCF 估值模型,计算得出每股价值为352.84元人民币。

- 敏感性分析: 对 WACC 和永续增长率进行了敏感性分析,以评估不同假设下的目标价。

- 与市场一致预期对比: 公司的盈利预测与市场一致预期相比,营收和净利润略低于市场预期,但运营利润率高于市场预期。

总结

迈瑞医疗在复杂的市场环境中展现出稳健的增长态势,并通过业务结构的优化和新业务的拓展,提升了盈利能力。尽管国内设备业务面临挑战,但 IVD 试剂业务和高端超声业务的快速增长,以及海外市场的拓展,为公司提供了新的增长动力。维持买入评级,并基于 DCF 模型调整了目标价。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送