-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Resilient 1H24 performance amid market headwinds

Resilient 1H24 performance amid market headwinds

-

下载次数:

1214 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2024-09-04

-

页数:

6页

联影医疗(688271)

United Imaging reported 1H24 revenue of RMB5,333mn, up by 1.2% YoY.Attributable net profit increased by 1.3% YoY to RMB950mn. Despite facing achallenging domestic market environment characterized by stringent industryregulations and delays in equipment renewal projects, United Imaging deliveredresilient performance thanks to the rapid growth of overseas business andmaintenance services. The rising revenue contribution from mid-to-high-endproducts and services drove the company's gross margin up by 1.7ppts YoY to50.4% in 1H24. Additionally, United Imaging announced an interim dividend plan,committed to distributing a total cash dividend of approximately RMB98.2mn, whichrepresents a more than 10% payout ratio.

Market share expanded in domestic medical equipment market. In 1H24,United Imaging’s equipment revenue decreased by 1.8% YoY toRMB4,540mn, primarily due to the delays in procurement activities. However,leveraging its product innovation and new product commercialization, thecompany’s high-end and ultra-high-end products gained market share. Forinstance, the market share of mid-to-high-end and ultra-high-end CT systemincreased by 11ppts YoY and 8ppts YoY, respectively. Its 3.0T MRI systemsalso gained 1.3ppts in market share of 3.0T MRI market. The companycontinues to hold a significant lead in ultra-high-filed MRI market with its 5.0TMRI system and saw a 5.3ppts YoY increase in market share of RT systems.

International operations sustained strong growth momentum. In 1H24,the company's overseas business achieved revenue of RMB933mn, up 29.9%YoY, accounting for 17.5% (+3.9ppts) of total revenue. The company deliveredrobust performance in Asia-Pacific, North America, and emerging markets,where revenues grew over 40% YoY, 26% YoY, and 132% YoY, respectively.Despite a 30% decrease in revenue from Europe due to seasonal fluctuations,efforts aimed at localizing operations in key European markets such as France,Italy, Germany, and Spain are anticipated to drive recovery in 2H24.

Growing contribution from services. In 1H24, revenue from maintenanceservices increased by 23.8% YoY to RMB617mn, accounting for 11.6%(+2.1ppts YoY) of the total revenue. Currently, United Imaging’s global installedbase has exceeded 20,000 units. With a growing installed base, we expect theservices revenue will continue to increase rapidly.

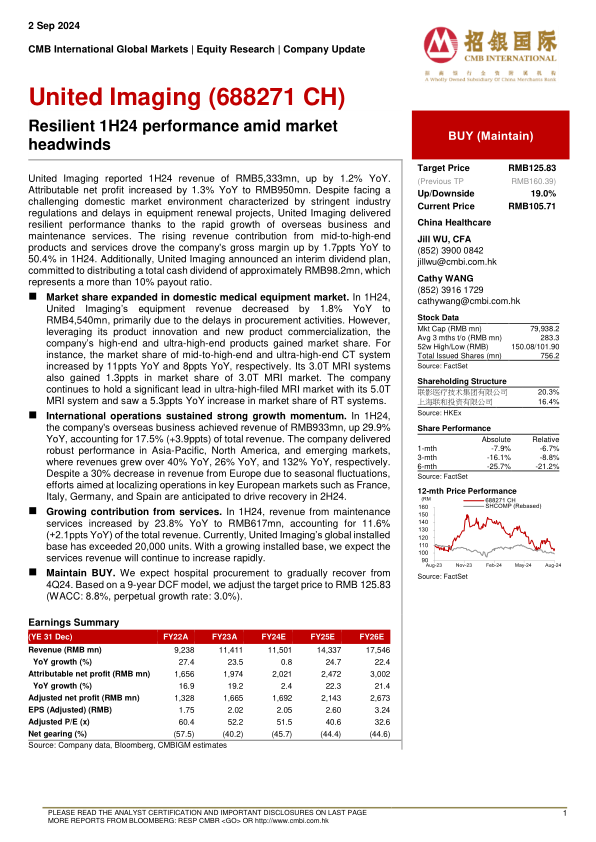

Maintain BUY. We expect hospital procurement to gradually recover from4Q24. Based on a 9-year DCF model, we adjust the target price to RMB 125.83(WACC: 8.8%, perpetual growth rate: 3.0%).

中心思想

- 业绩韧性与增长动力: 尽管面临国内市场挑战,联影医疗(688271 CH)凭借海外业务的快速增长和维护服务收入的提升,实现了2024年上半年业绩的稳健增长。

- 市场份额扩张与产品结构优化: 公司在中高端和超高端CT系统以及3.0T MRI系统等领域扩大了市场份额,产品结构的优化推动了毛利率的提升。

- 维持买入评级与目标价调整: 考虑到医院采购有望在2024年第四季度逐步恢复,基于DCF模型,将目标价调整为人民币125.83元。

主要内容

公司业绩概览

- 营收与净利润: 联影医疗2024年上半年营收为人民币53.33亿元,同比增长1.2%;归母净利润为人民币9.50亿元,同比增长1.3%。

- 毛利率提升: 中高端产品和服务收入占比上升,推动毛利率同比上升1.7个百分点至50.4%。

- 中期股息计划: 公司宣布中期股息计划,派发现金股息约人民币9820万元,派息率超过10%。

国内市场份额扩张

- 设备收入下降但市场份额提升: 尽管受采购延迟影响,设备收入同比下降1.8%至人民币45.40亿元,但公司通过产品创新和新产品商业化,提高了中高端和超高端产品的市场份额。

- 高端产品市场表现: 中高端CT系统市场份额同比增长11个百分点,超高端CT系统市场份额同比增长8个百分点,3.0T MRI系统市场份额也有所增长。

- 超高场MRI市场领先地位: 公司在超高场MRI市场保持领先地位,RT系统市场份额同比增长5.3个百分点。

国际业务强劲增长

- 海外营收增长显著: 2024年上半年,海外业务收入达到人民币9.33亿元,同比增长29.9%,占总收入的17.5%(同比增长3.9个百分点)。

- 各区域市场表现: 亚太、北美和新兴市场收入分别同比增长超过40%、26%和132%。

- 欧洲市场策略: 尽管欧洲市场收入因季节性因素下降30%,但公司在法国、意大利、德国和西班牙等主要欧洲市场推进本地化运营,预计下半年将实现复苏。

服务收入贡献增加

- 维护服务收入增长: 2024年上半年,维护服务收入同比增长23.8%至人民币6.17亿元,占总收入的11.6%(同比增长2.1个百分点)。

- 装机量增长驱动服务收入: 随着全球装机量超过20,000台,预计服务收入将继续快速增长。

盈利预测调整

- 营收预测调整: 2024E、2025E和2026E的营收预测分别下调16.95%、15.23%和14.94%。

- 净利润预测调整: 2024E、2025E和2026E的净利润预测分别下调13.99%、13.48%和14.38%。

估值

- DCF估值: 基于9年期DCF模型,目标价调整为人民币125.83元(WACC为8.8%,永续增长率为3.0%)。

总结

本报告分析了联影医疗2024年上半年的业绩表现,尽管面临国内市场挑战,公司通过海外业务的快速增长和维护服务收入的提升,实现了业绩的稳健增长。同时,公司在中高端和超高端产品市场份额的扩张以及产品结构的优化,也为未来的增长奠定了基础。考虑到医院采购有望在2024年第四季度逐步恢复,维持对联影医疗的买入评级,并将目标价调整为人民币125.83元。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送