-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Healthy non-COVID revenue growth in 1Q23

Healthy non-COVID revenue growth in 1Q23

-

下载次数:

1841 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2023-04-27

-

页数:

5页

泰格医药(300347)

Tigermedreported1Q23revenueofRMB1,805mn,down0.7%YoY,andattributablerecurringnetincomeofRMB381mn,up0.7%YoY.1Q23revenue/attributablerecurringnetincomeaccountedfor21.2%/19.2%respectivelyofour2023full-yearestimates,whichwereinlinewithitshistoricalaveragelevel.1Q23revenuewouldgrowby27-28%YoYifexcludingCOVIDrelatedrevenue.Grossprofitmargin(GPM)in1Q23was39.7%,improvingby1.6pptQoQand0.8pptYoY,thankstothedecreasedproportionofrevenuefromCOVID-19relatedprojects(includingpass-throughrevenuetooverseassub-contractors)aswellasbusinessnormalizationinChinasinceFeb2023.Accordingtomanagement,GPMwouldbeabove41%ifexcludingCOVIDpass-throughrevenue.Neworderssignedin1Q23waslargelyflatYoY,whilemanagementexpectsasignificantpickupinnewordersgrowthfrom2Q23giventherecoveryofrequestsforproposalsince1Q23.

Operation fully resumed after the COVID pandemic, laying a soundfoundation for full-year growth. Management indicated that COVIDinfection among employees had disrupted business operations in Jan 2023,with China-based laboratory services taking the most hit. According toFrontage (1521 HK), revenue declined by 1.8% YoY while adjusted net profitdropped by 77% YoY in 1Q23. With business operation resumed normal,management expected both revenue and GPM to see sequentialimprovements in 2Q23.

Globalization remains a business focus. Tigermed acquired a Croatiabased clinical CRO, Marti Farm, in Jan 2023, further enhancing its servicecapability in Europe. The Company is integrating its BD team in Europe toenhance BD capabilities. In the US, Tigmerd aims to double its local clinicaloperation team to over 100 staff in 2023. The Company’s strategies inEurope and US include collaborating with small- to mid- sized clients withrelatively inadequate access to resource of global clinical CROs andChinese clients going to developed markets. Additionally, Tigermed takes aproactive approach in Southeast Asia and Latin America. Such regions arepotential end markets for Chinese drug developers, which will createadditional demand for Tigermed in overseas market.

Operating cash flow to recover. Net operating cash flow substantiallydeclined by 91% YoY to RMB29mn, due to 1) delay in part of cost paymentfrom 4Q22 to 1Q23 due to COVID outbreak; 2) sizable income from COVIDvaccine projects in 1Q22 which caused a high base; and 3) the increasingstaff cost due to the growing employee number. Management guided netoperating cash flow to rebound from 2Q23.

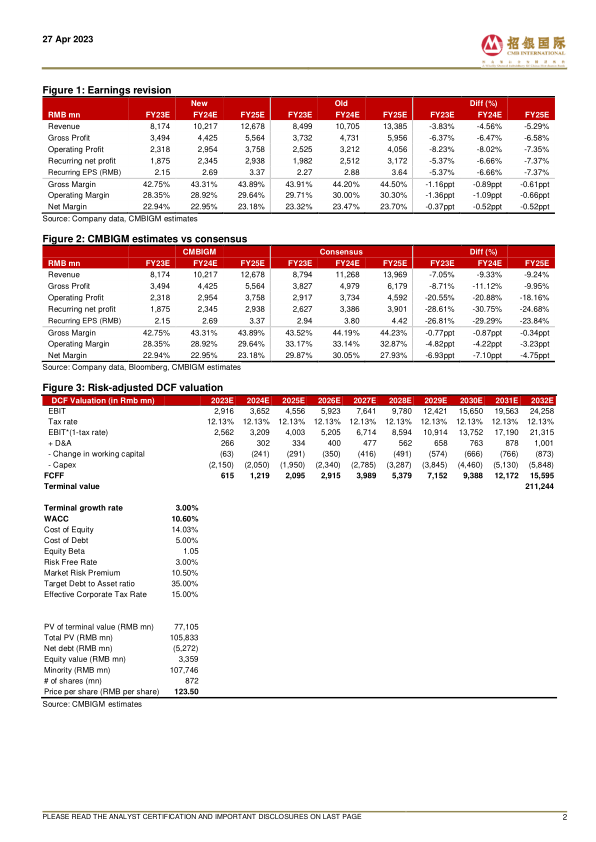

Maintain BUY. We revised our TP from RMB134.24 to RMB123.50, basedon a 10-year DCF model (WACC: 10.6%, terminal growth: 3.0%), to factorin slower revenue growth projection. We forecast Tigermed’s revenue togrow 15.4%/ 25.0%/ 24.1% YoY and attributable recurring net income to grow21.8%/ 25.0%/ 25.3% YoY in FY23E/ 24E/ 25E, respectively.

中心思想

- 非新冠业务健康增长: 剔除新冠相关收入后,泰格医药一季度收入同比增长27-28%,表明公司核心业务稳健。

- 盈利能力提升预期: 随着新冠相关项目收入占比下降和国内业务正常化,公司毛利率有望进一步提升,管理层预计排除新冠通行收入后毛利率将超过41%。

- 维持买入评级,目标价调整: 考虑到收入增长放缓,将目标价从134.24人民币下调至123.50人民币,但维持买入评级,预计未来几年收入和净利润将保持增长。

主要内容

1Q23 业绩回顾

- 营收与净利润: 泰格医药公布 2023 年第一季度营收 18.05 亿元人民币,同比下降 0.7%;归属于母公司经常性净利润 3.81 亿元人民币,同比增长 0.7%。

- 营收占比: 一季度营收和归属于母公司经常性净利润分别占我们全年预测的 21.2% 和 19.2%,与历史平均水平一致。

- 剔除新冠影响后的增长: 如果排除新冠相关收入,一季度营收将同比增长 27-28%。

毛利率分析

- 毛利率提升: 2023 年第一季度毛利率为 39.7%,环比增长 1.6 个百分点,同比增长 0.8 个百分点,主要得益于新冠相关项目收入占比下降。

- 业务正常化: 自 2023 年 2 月以来,中国业务正常化也对毛利率提升有所贡献。

- 未来展望: 管理层预计,如果排除新冠通行收入,毛利率将超过 41%。

新签订单与业务恢复

- 新签订单: 一季度新签订单与去年同期基本持平,但管理层预计,随着自一季度以来项目建议书需求的复苏,二季度新签订单增长将显著回升。

- 运营恢复: 在新冠疫情后,运营已全面恢复,为全年增长奠定了坚实的基础。

- 疫情影响: 管理层表示,2023 年 1 月员工中的新冠感染扰乱了业务运营,其中中国实验室服务受到的打击最大。

- 业绩下滑: 药明康德(Frontage)(1521 HK)一季度营收同比下降 1.8%,调整后净利润同比下降 77%。

- 二季度展望: 随着业务运营恢复正常,管理层预计营收和毛利率将在二季度实现环比增长。

全球化战略

- 欧洲市场拓展: 泰格医药于 2023 年 1 月收购了一家位于克罗地亚的临床 CRO 公司 Marti Farm,进一步增强了其在欧洲的服务能力。

- 团队整合: 公司正在整合其在欧洲的 BD 团队,以增强 BD 能力。

- 美国市场扩张: 在美国,泰格医药计划在 2023 年将其本地临床运营团队扩大一倍以上,达到 100 多人。

- 市场策略: 公司在欧洲和美国的战略包括与那些相对缺乏全球临床 CRO 资源的中小型客户以及进军发达市场的中国客户合作。

- 新兴市场: 此外,泰格医药还在东南亚和拉丁美洲采取积极措施。这些地区是中国药物开发商的潜在终端市场,这将为泰格医药在海外市场创造额外的需求。

现金流分析

- 运营现金流下降: 经营活动产生的现金流量净额同比大幅下降 91% 至 2900 万元人民币,原因是:1)部分成本支付从 2022 年四季度延迟至 2023 年一季度,原因是新冠疫情爆发;2)2022 年一季度新冠疫苗项目收入规模较大,导致基数较高;3)员工人数增加导致员工成本增加。

- 现金流反弹预期: 管理层预计,经营活动产生的现金流量净额将从 2023 年二季度开始反弹。

盈利预测与估值

-

盈利预测调整: 我们调整了盈利预测,以反映收入增长放缓的预期。

- 收入预测: 预计 2023E/24E/25E 收入同比增长 15.4%/25.0%/24.1%。

- 归母净利润预测: 预计 2023E/24E/25E 归属于母公司经常性净利润同比增长 21.8%/25.0%/25.3%。

- 目标价调整: 基于 10 年 DCF 模型(WACC:10.6%,永续增长率:3.0%),我们将目标价从 134.24 人民币调整至 123.50 人民币。

总结

- 核心业务稳健增长: 泰格医药一季度剔除新冠相关收入后,收入同比增长27-28%,显示其核心业务的健康增长态势。

- 盈利能力有望提升: 随着新冠相关项目收入占比下降和国内业务正常化,公司毛利率有望进一步提升。

- 维持买入评级: 尽管目标价有所下调,但维持买入评级,并预计未来几年收入和净利润将保持增长。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送