-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Business stabilizing from late September

Business stabilizing from late September

-

下载次数:

2614 次

-

发布机构:

CMB International Capital Corporation Limited

-

发布日期:

2023-10-30

-

页数:

5页

泰格医药(300347)

Tigermed reported 3Q23 revenue of RMB1,940mn, up 7.1% YoY (vs +3.3%YoY in 1H23), and attributable recurring net income of RMB405mn, down 3.8%YoY (vs +2.9% YoY in 1H23). 3Q23 revenue accounted for 24.9% of our 2023full-year estimate, in line with its historical average, while attributable recurringnet income represented 22.7% of our forecast, which fell short of its historicalaverage of ~27%. If excluding COVID vaccine revenue, 3Q23 revenue wouldgrow by ~18% YoY (vs ~27% YoY in 1H23). Management indicated a policyheadwind impacting patient enrolments in 3Q23, which has already largelyresumed normal by late Sep. Gross profit margin (GPM) in 3Q23 continuouslyrose to 41.2%, improving by 1.0ppt QoQ and 0.2ppt YoY. According tomanagement, GPM would be ~41.7% if excluding COVID vaccine revenue,which declined 1.3ppt YoY. The adj. gross margin dilution was mainly due tothe impact from policy headwinds, margin pressure from lab business and thestrong recovery of low-margin SMO services. Additionally, new orders(excluding pass-through fees) signed in the quarter achieved positive growthamid the harsh business environment. Tigermed’s operating cash flows in 9M23was RMB673mn, down 18.5% YoY.

Globalization to serve as a long-term driver. Tigermed acquired aCroatia-based clinical CRO, Marti Farm, in Jan 2023, further enhancing itsservice capability in Europe. Althrough the Company adjusted its personnelin Europe to reflect the post-COVID demand changes, Europe still plays acritical role for patient enrolments in MRCTs as well as for biosimilarprojects. In the US, Tigermed doubled its local clinical operation team tomore than 110 staff in 1H23. In the Europe and US market, Tigermedstrategically aims to collaborate with small- to mid- sized companies withintention of incorporating China in their MRCTs (especially CGT projects)and Chinese clients going to overseas markets. Management expected thegrowth of the US and EU business to outpace that of Tigermed as a whole.Besides, Southeast Asia and Latin America market with large populationbases continue to remain as strategic end markets for Chinese pharmacompanies in the long term, creating extra business opportunities forTigermed.

ADC and obesity to trigger additional clinical demands. Although theglobal biotech market has saw an initial inflection point in terms of financing,management of Tigermed pointed out the continuously decreasing risktolerance of clients, leading to the longer waiting time from request-forproposals (RFPs) to contract signing. However, management indicated thatthe successful POC and commercialization of certain products ininternational market, such as ADC and obesity drugs, will bring additionalclinical demands to clinical CROs. Specifically, Tigermed has alreadyobserved a growing interest from client on obesity drugs.

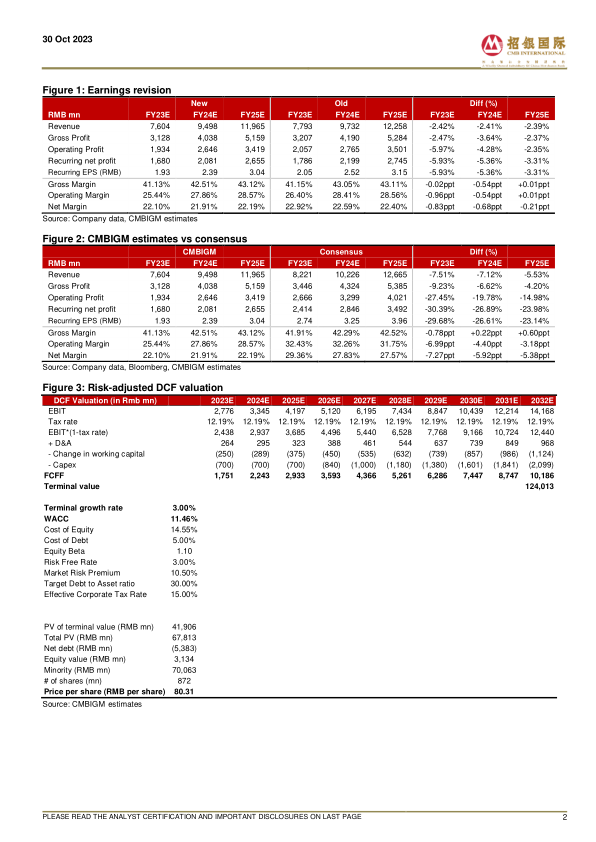

Maintain BUY. We revised our TP from RMB94.41 to RMB80.31, based ona 10-year DCF model (WACC: 11.5%, terminal growth: 3.0%), to factor inslower projection of recurring net income growth. We forecast Tigermed’srevenue to grow 7.3%/ 24.9%/ 26.0% YoY and attributable recurring netincome to grow 9.2%/ 23.8%/ 27.6% YoY in FY23E/ 24E/ 25E, respectively.

中心思想

- 业绩表现与预期: 2023年第三季度,剔除新冠疫苗收入后,泰格医药的收入同比增长约18%,但经常性净利润略低于历史平均水平。

- 全球化战略: 泰格医药通过收购和扩张,持续推进全球化布局,尤其是在欧洲和美国市场,旨在服务国内外客户的MRCT项目。

- 未来增长点: ADC药物和肥胖症药物的成功商业化,预计将为临床CRO带来额外的临床需求,泰格医药已观察到客户对肥胖症药物的兴趣增长。

- 投资评级调整: 维持“买入”评级,但基于经常性净利润增长放缓的预期,将目标价从80.31人民币下调至94.41人民币。

主要内容

公司业绩回顾

-

营收与利润分析

- 泰格医药公布了2023年第三季度的业绩,收入为19.4亿元人民币,同比增长7.1%;经常性净利润为4.05亿元人民币,同比下降3.8%。

- 若排除新冠疫苗收入,第三季度收入同比增长约18%。

-

毛利率分析

- 第三季度毛利率持续上升至41.2%,环比增长1.0个百分点,同比增长0.2个百分点。

- 若排除新冠疫苗收入,毛利率约为41.7%,同比下降1.3个百分点。

业务发展与战略

-

全球化扩张

- 2023年1月,泰格医药收购了克罗地亚的临床CRO公司Marti Farm,以增强其在欧洲的服务能力。

- 在美国,泰格医药将其本地临床运营团队扩大了一倍,超过110人。

-

市场策略

- 泰格医药的战略目标是与中小型公司合作,将中国纳入其MRCT,并帮助中国客户走向海外市场。

- 东南亚和拉丁美洲市场仍然是中国制药公司的战略终端市场,为泰格医药创造了额外的商机。

-

新业务增长点

- ADC药物和肥胖症药物的成功商业化将为临床CRO带来额外的临床需求,泰格医药已观察到客户对肥胖症药物的兴趣增长。

财务分析与预测

-

盈利预测

- 预计泰格医药2023财年、2024财年和2025财年的收入将分别同比增长7.3%、24.9%和26.0%。

- 预计2023财年、2024财年和2025财年的经常性净利润将分别同比增长9.2%、23.8%和27.6%。

-

估值调整

- 基于10年期DCF模型(WACC:11.5%,终值增长率:3.0%),将目标价从94.41人民币调整为80.31人民币,以反映经常性净利润增长放缓的预期。

财务报表摘要

-

利润表

- 提供了2020A至2025E的收入、成本、毛利润、运营费用、运营利润、税前利润、净利润等关键财务指标。

-

资产负债表

- 提供了2020A至2025E的流动资产、非流动资产、流动负债、非流动负债、股东权益等关键财务指标。

-

现金流量表

- 提供了2020A至2025E的经营活动现金流、投资活动现金流、融资活动现金流等关键财务指标。

-

增长率

- 列出了2020A至2025E的收入增长率、毛利润增长率、运营利润增长率、净利润增长率等。

-

盈利能力

- 列出了2020A至2025E的毛利率、运营利润率、净利润率、ROE等。

-

估值

- 列出了2020A至2025E的P/E、P/B、P/CFPS、股息率等。

总结

本报告分析了泰格医药2023年第三季度的业绩,并对其业务发展战略、财务状况和未来增长前景进行了评估。报告指出,泰格医药的全球化战略正在稳步推进,尤其是在欧美市场。同时,ADC药物和肥胖症药物等新兴领域的需求增长将为公司带来新的机遇。尽管业绩增长略低于预期,但维持对泰格医药的“买入”评级,目标价调整为80.31人民币。报告还提供了详细的财务报表摘要,包括利润表、资产负债表、现金流量表以及关键财务指标的预测,为投资者提供了全面的参考信息。

-

Overseas strength offsets domestic softness

-

Strong recovery in Q3

-

Rising demand for small molecule D&M business

-

Impressive growth amid uncertain environment

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送