-

{{ listItem.name }}快速筛选药品,用摩熵药筛

微信扫一扫-立即使用

微信扫一扫-立即使用

Targeting the broad global market

Targeting the broad global market

-

下载次数:

504 次

-

发布机构:

CMB International Securities Limited

-

发布日期:

2023-03-31

-

页数:

5页

泰格医药(300347)

Tigermed reported 2022 revenue/ attributable net income/ attributable recurring netincome of RMB7,085mn/ RMB2,007mn/ RMB1,540mn, +35.9% YoY/ -30.2% YoY/+25.0% YoY. Revenue was largely in line with our forecast while attributablerecurring net income missed our forecast by 8.9%. The decline of attributablenet income in 2022 was mainly due to the decreased fair value gains fromRMB1,815mn in 2021 to RMB536mn in 2022. Gross profit margin (GPM)deteriorated by 3.9ppt to 39.6% in 2022, due to the revenue recognition fromlow-margin COVID-19 related revenue (including pass-through revenue tooverseas sub-contractors) as well as the COVID pandemic in China. New ordersamounted to RMB9.7bn in 2022, flattish vs 2021; while non-COVID-19 relatednew orders increased by c.25% YoY in 2022, demonstrating a robust growth ofthe core business. Total backlog reached RMB13.8bn (+22.9% YoY) by the endof 2022, a solid guarantee for sustainable growth.

Accelerating globalization. Tigermed has utilized COVID-19 pandemic asan opportunity to access and expand overseas markets. The Companyenabled 4 COVID-19 vaccine EUAs in China and overseas in 2022. Inaddition, Tigermed acquired a Croatia-based clinical CRO, Marti Farm, inJan 2023, further enhancing its service capability in Europe. Themanagement indicated that the Company will integrate BD team in Europeto enhance BD efficiency in 2023. In the US, Tigmerd had collaborationswith over 100 clinical sites. With its growing global network and good trackrecord, Tigermed has won more chances to participate in MRCT projects.As of Dec 2022, the Company had 62 MRCT projects in the pipeline,compared with only 20 as of Dec 2020. Tigermed also takes a proactiveapproach to explore business opportunities in Southeast Asia and LatinAmerica. Such regions are potential end markets for Chinese drugdevelopers, which will create additional demand for Tigermed in overseasmarket. To fuel its global expansion, Tigermed added 400 employees inoverseas regions, representing 44% of the total new hiring in 2022.

Adopting new technologies to enhance work efficiency. Tigermedestablished Tigermed Digital Promotion Center and Decentralized ClinicalTrial (DCT) Solution Team. DCT platform uses new technologies to performcritical clinical trial related procedures, such as participant enrolment/engagement, site management, data aggregation, quality/ cost balance andstudy services. DCT platform, already used in certain projects, will reducepatient burden and improve clinical service efficiency. We think the launchof DCT platform will help Tigermed to keep up with leading foreign peersregarding service digitalization and work efficiency.

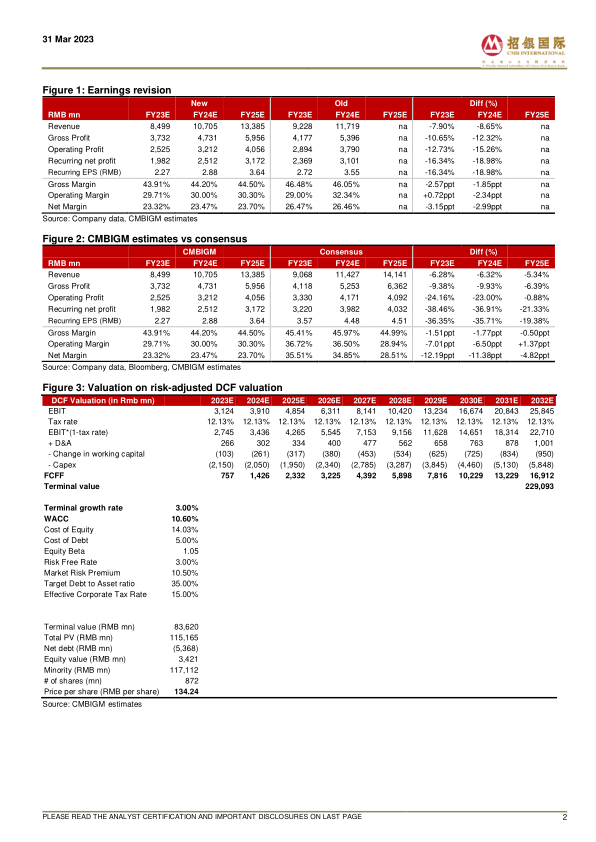

Maintain BUY. We revised our TP from RMB147.43 to RMB134.24, basedon a 10-year DCF model (WACC: 10.6%, terminal growth rate: 3.0%), tofactor in slower revenue growth projection. We forecast Tigermed’s revenueto grow 20%/ 26%/ 25% YoY and attributable recurring net income to grow29%/ 27%/ 26% YoY in FY23E/ 24E/ 25E, respectively.

中心思想

- 全球化加速是增长引擎: 泰格医药正积极拓展海外市场,通过抓住疫情带来的机遇,以及收购欧洲CRO公司Marti Farm,增强了其在欧洲的服务能力。同时,公司积极参与国际多中心临床试验(MRCT)项目,并在东南亚和拉丁美洲探索商机,这些都将为公司带来额外的海外市场需求。

- 技术创新提升效率: 泰格医药成立了数字化推广中心和分散式临床试验(DCT)解决方案团队,利用新技术优化临床试验流程,如患者招募、数据聚合等,从而降低患者负担,提高临床服务效率。DCT平台的推出有助于公司在服务数字化和工作效率方面与国际领先企业保持同步。

- 维持买入评级,但下调目标价: 基于对收入增长放缓的预期,将目标价从147.43人民币下调至134.24人民币,但维持买入评级。预计公司2023E/24E/25E收入将同比增长20%/26%/25%,归母净利润将同比增长29%/27%/26%。

主要内容

公司业绩回顾

泰格医药2022年收入为70.85亿元人民币,同比增长35.9%;归母净利润为20.07亿元人民币,同比下降30.2%;归母扣非净利润为15.40亿元人民币,同比增长25.0%。收入基本符合预期,但归母扣非净利润低于预期8.9%。净利润下降主要是由于金融资产公允价值变动收益从2021年的18.15亿元人民币降至2022年的5.36亿元人民币。毛利率下降3.9个百分点至39.6%,主要由于低毛利率的新冠相关收入以及国内疫情影响。

新订单与积压订单

2022年新订单金额为97亿元人民币,与2021年基本持平;但非新冠相关新订单同比增长约25%,表明核心业务增长强劲。截至2022年底,总积压订单达到138亿元人民币,同比增长22.9%,为可持续增长提供了坚实保障。

全球化战略

泰格医药利用疫情作为契机,进入并扩大海外市场。2022年,公司促成了4个新冠疫苗在国内外获得紧急使用授权(EUA)。此外,公司还收购了克罗地亚的临床CRO公司Marti Farm,进一步增强了其在欧洲的服务能力。公司管理层表示,将在2023年整合欧洲的BD团队,以提高BD效率。在美国,泰格医药与100多家临床试验中心建立了合作关系。凭借其不断增长的全球网络和良好的业绩记录,泰格医药赢得了更多参与MRCT项目的机会。截至2022年12月,公司有62个MRCT项目在进行中,而2020年12月仅为20个。泰格医药还积极探索在东南亚和拉丁美洲的商机。为了推动其全球扩张,泰格医药在海外地区增加了400名员工,占2022年新增员工总数的44%。

技术应用与效率提升

泰格医药成立了泰格医药数字化推广中心和分散式临床试验(DCT)解决方案团队。DCT平台利用新技术执行关键的临床试验相关程序,如参与者招募/参与、现场管理、数据聚合、质量/成本平衡和研究服务。DCT平台已在某些项目中得到应用,将减少患者负担并提高临床服务效率。DCT平台的推出将有助于泰格医药在服务数字化和工作效率方面与领先的外国同行保持同步。

盈利预测与估值调整

将泰格医药的目标价从147.43人民币调整至134.24人民币,基于10年期DCF模型(WACC:10.6%,永续增长率:3.0%),以反映收入增长放缓的预期。预计泰格医药2023E/24E/25E的收入将分别增长20%/26%/25%,归属于母公司的经常性净利润将分别增长29%/27%/26%。

盈利预测调整

- 收入与利润下调: 报告中对泰格医药未来三年的收入和利润预期进行了下调。具体而言,2023E收入从92.28亿元人民币下调至84.99亿元人民币,降幅为7.90%;2024E收入从117.19亿元人民币下调至107.05亿元人民币,降幅为8.65%。经常性净利润也分别下调了16.34%(2023E)和18.98%(2024E)。

- 毛利率与净利率变化: 毛利率预期也略有下调,2023E和2024E分别下调了2.57个百分点和1.85个百分点。净利率同样有所下调,2023E和2024E分别下调了3.15个百分点和2.99个百分点。

估值对比

- 与市场一致预期对比: 报告中将CMBIGM对泰格医药的盈利预测与市场一致预期进行了对比。结果显示,CMBIGM的预测普遍低于市场一致预期。例如,2023E的收入预期低6.28%,经常性净利润预期低38.46%。

- 利润率差异显著: 在利润率方面,CMBIGM的预测也低于市场一致预期。例如,2023E的净利率预期低12.19个百分点。

总结

本报告分析了泰格医药2022年的业绩表现,并对其全球化战略、技术创新以及未来盈利能力进行了评估。报告指出,泰格医药正积极拓展海外市场,并通过技术创新提升效率,但同时也面临着收入增长放缓和利润率下降的挑战。基于这些因素,CMBIGM维持对泰格医药的买入评级,但下调了目标价。报告还对比了CMBIGM的盈利预测与市场一致预期,显示CMBIGM的预测更为保守。

-

Business recovery from 2Q20

-

Establishing leading integrated CRO/CDMO platform

摩熵咨询是摩熵数科旗下生物医药专业咨询服务品牌,由深耕医药领域多年的专业人士组成,核心成员均来自国际顶级咨询机构和行业标杆企业,涵盖立项、市场、战略、投资等从业背景,依托摩熵数科丰富的外部专家资源及全面的医药全产业链数据库,为客户提供专业咨询服务和定制化解决方案

最新报告

对不起!您还未登录!请登陆后查看!

您今日剩余【10】次下载额度,确定继续吗?

请填写你的需求,我们将尽快与您取得联系

{{nameTip}}

{{companyTip}}

{{telTip}}

{{sms_codeTip}}

{{emailTip}}

{{descriptionTip}}

*请放心填写您的个人信息,该信息仅用于“摩熵咨询报告”的发送